- DEFINITION OF SEAFARER OR MERCHANT NAVY

To begin with, the Income Tax Act, 1961 (‘Act’) does not explicitly define the terms ‘Seafarer’ or ‘Merchant Navy’. There are no specific provisions within the Income Tax Act that offer exemption or taxation criteria for individuals identified as ‘Seafarers’ or associated with the ‘Merchant Navy’. Broadly speaking, a Seafarer or Merchant Navy Worker refers to an individual employed or engaged in travel aboard a boat or ship on the sea. A Seafarer undertakes the navigation of a sea vessel or participates as a crew member in the functioning and/or upkeep of a ship as per the terms of their employment contract.

- EARNINGS OF SEAFARER

The typical remuneration received by Seafarers usually comes in the form of salaries from their respective employer companies.

- INCOME TAX ON SEAFARER FOR FINANCIAL YEAR 2020-21

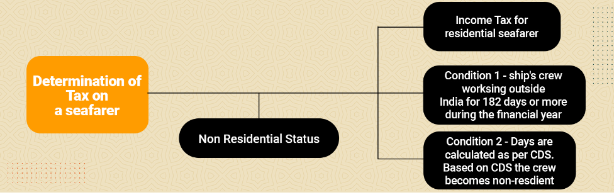

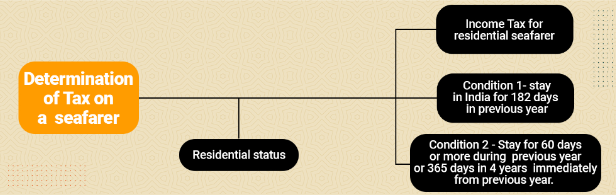

The tax implications of the salary earned by a seafarer or individual in the Merchant Navy are entirely determined by the residential status of the seafarer or Merchant Navy personnel.

- RESIDENT SEAFARER

The income received as salary by a resident seafarer or individual in the Merchant Navy will be subject to taxation by the regulations set forth by the Income Tax Department. No specific exemptions are provided in this regard.

- NON-RESIDENT SEAFARER

The salary earned by a non-resident seafarer will NOT form part of the seafarer’s total taxable income.

- NEW DEEMED RESIDENT PROVISION FROM FINANCIAL YEAR 2020-21

A new provision, Section 6(1A), was introduced by the Financial Act 2020, which became effective from the financial year 2020-21 (from 1st April 2020 to 31st March 2021). Under this provision, an individual (including Ship Worker) who is an Indian citizen can be considered a Resident in India if their stay in India exceeds 119 days (i.e., 120 days or more) during a financial year. This particular regulation could significantly impact the tax status of employees in the merchant navy and seafarers if they are classified as Residents in India under the new Residency Tax Rule.

The new 120-day rule applies to individuals whose Total Taxable Income in India surpasses Rs 15 lakhs. However, Non-Resident Indian (NRI) ship workers (Seafarers) are still eligible for determination based on the 182-day Residency rule, and the 120-day rule will not be applicable to them. It is noteworthy that for calculating the Rs 15 lakh threshold, their income earned from ship-related activities will not be taken into account.

- IS IT MANDATORY TO FILE INCOME TAX RETURN IN INDIA

A Seafarer is not subject to taxation or required to file Income Tax Returns (ITR) in any country worldwide. Therefore, despite it not being mandatory under Indian Income Tax Rules, it holds great significance and advantages for a Seafarer to submit an ITR in India. Filing an ITR serves as a crucial document for multiple purposes, such as supporting loan applications, visa applications, and acts as an official record or evidence in addressing any potential inquiries from the Income Tax Department in the future.

- FAQ’S

Q.1 Are Indian seafarers liable to pay taxes?

If individuals are outside India for more than 184 days (or 185 days in a leap year) based on their CDC/passport records, they are not obligated to pay taxes on their earnings from the merchant navy.

Q.2 Are seafarers considered as NRI’s?

Indeed, if their stay outside India exceeds 184 days (or 185 days in a leap year) according to their CDC/passport records, they are classified as Non-Resident Indians under the Income Tax Act, 1961.

Q.3 Which banks are suitable for seafarers?

They are eligible to hold NRE/NRO accounts in either Public Sector Banks or private banks.

Q.4 What is the difference between NRO and NRE account?

In an NRE account, only foreign currency or a check from another NRE account can be deposited. However, an NRO account is designed as a savings account for non-residents where they can deposit Indian currency or any check from a regular savings account.

Disclaimer: The materials provided herein are for informational purposes only and do not constitute legal, financial, or professional advice. Consult relevant laws and experts before acting on this information. Neither the author nor K M GATECHA & CO LLP is liable for any inaccuracies or omissions. This material is purely educational and not an advertisement or solicitation.