Explore transfer pricing in India, key methods (CUP, TNMM, RPM), and compliance with tax rules. Learn how to reduce risk and stay audit-ready.

Transfer pricing refers to the pricing of goods, services, or intangibles between related entities within a multinational enterprise (MNE). It plays a crucial role in determining how profits are allocated among various jurisdictions and directly affects the tax liabilities of an organization. Understanding transfer pricing is essential for businesses operating across borders to remain compliant with tax laws and optimize tax efficiency.

Transfer pricing refers to the valuation assigned to goods or services exchanged between affiliated entities. Put simply, it represents the price paid for goods or services transferred from one division of an organization to another located in different countries (with some exceptions).

International Transactions Governed by Transfer Pricing

Here are various international transactions falling under the purview of transfer pricing regulations:

- Selling finished products

- Acquiring raw materials

- Procuring fixed assets

- Trading machinery and similar items

- Exchanging intangible assets

- Reimbursing expenses incurred or received

- Engaging in IT-enabled services

- Providing support services

- Developing software

- Offering technical services

- Charging management fees

- Assessing royalty payments

- Implementing corporate guarantee agreements

- Extending or receiving loans

Objectives of Transfer Pricing

The primary aims of implementing transfer pricing include:

- Creating distinct profits for individual divisions, facilitating separate evaluation of each division’s performance.

- Transfer prices influence not only the reported profits of each center but also impact the allocation of a company’s resources, where costs incurred by one center are regarded as the resources utilized by them.

- ✅ Objectives of Transfer Pricing

Transfer pricing is not merely about setting prices—it is a strategic, legal, and tax-centric tool aimed at achieving multiple goals:

- Profit Allocation

Ensure appropriate distribution of profit among various entities in different tax jurisdictions.

- Compliance with Legal and Tax Regulations

Comply with local and international tax laws, particularly those prescribed by OECD and the Income Tax Act, 1961 in India.

- Avoidance of Double Taxation

Ensure the same income is not taxed twice in different countries.

- Performance Measurement

Evaluate the profitability of each division/subsidiary objectively based on market-determined pricing.

- Risk Management

Allocate risks and rewards in line with the entity’s functional profile and capital employed.

Significance of Transfer Pricing

Multinational corporations (MNCs) possess a degree of flexibility in determining how profits and expenses are distributed among their subsidiaries across different countries for management accounting and reporting purposes.

At times, subsidiaries may be structured into segments or treated as standalone entities. Transfer pricing plays a crucial role in accurately allocating revenue and expenses to such subsidiaries.

The profitability of a subsidiary hinges on the pricing of inter-company transactions, which are now subject to heightened governmental scrutiny. The application of transfer pricing can significantly impact shareholder wealth by influencing the company’s taxable income and its after-tax cash flow.

For businesses engaged in cross-border intercompany transactions, understanding transfer pricing concepts is imperative. This understanding is essential not only for compliance with legal requirements but also for mitigating the risks associated with non-compliance.

Transfer Pricing Approaches

The guidelines provided by the Organisation for Economic Co-operation and Development (OECD) outline various methodologies for determining the arm’s-length price of controlled transactions.

In this context, the arm’s-length price denotes the price applied, proposed, or charged when unrelated parties engage in similar transactions under uncontrolled conditions. Among the numerous transfer pricing methods, three are commonly utilized.

To clarify, associated enterprises are defined as entities that are directly or indirectly involved in the management, capital, or control of another enterprise.

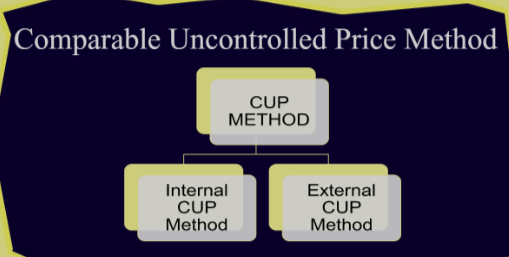

Comparable Uncontrolled Price (CUP) Method

The CUP method involves assessing the price observed in an uncontrolled transaction between comparable firms to determine the Arm’s Length Price. For instance:

A Ltd. buys 10,000 MT of metal from its subsidiary B Ltd. at INR 30,000/MT and 2,500 MT from C Ltd. at INR 40,000/MT. A Ltd. receives a quantity discount of INR 500/MT from B Ltd. and is offered a one-month credit period at 1.25% per month. The transaction with B Ltd. is FOB, while with C Ltd. it is CIF, with freight and insurance costs totaling INR 1,000.

As the terms of the transactions differ, they affect the cost of the metal. Hence, adjustments are necessary for the following disparities:

- Quantity discount: If C Ltd. had offered a similar discount, their price would have been INR 500/MT lower.

- Freight & Insurance (FOB Vs CIF): If the purchase from C Ltd. was also FOB, their price would have been lower. Thus, the freight and insurance cost must be deducted from the purchase price.

- Credit period: If C Ltd. had offered a similar credit period, their price would have been higher after considering this cost. Therefore, 1.25% per month must be added to the purchase price.

This approach is widely regarded as the most dependable and direct method for applying the arm’s-length principle and establishing prices for transactions between related parties. However, careful consideration is crucial when determining whether controlled and uncontrolled transactions are comparable. Therefore, this method of determining transfer prices is only utilized when products or services meet strict criteria for high comparability.

Resale Price Method or Resale Minus Method

This approach involves examining the prices at which the associated enterprise sells its product to third parties, known as the resale price. The gross profit, determined by comparing it with the gross profit in comparable uncontrolled transactions, is then subtracted from this resale price. Subsequently, costs related to the purchase of such products, such as customs duty, are deducted. The resulting amount is considered the arm’s length price for transactions between associated enterprises.

Example: An Ltd is engaged in the sale of IT products. An Ltd has purchased desktops from both a related party, B Ltd, and a non-related party, C Ltd.

Particulars | B Ltd. (AE) | C Ltd. (Non-AE) |

Purchase price of A Ltd. | INR 30,0000 | INR 44,000 |

Sales Price of A Ltd. | INR 36,000 | INR 52,000 |

Other Expenses incurred by A Ltd | INR 500 | INR 800 |

Gross Margin | 18.33% | 13.85% |

Cost Plus Method

The Cost Plus Method focuses on the costs incurred by the supplier of goods or services in the controlled transaction. After determining these costs, a markup is added. This markup should represent the profit for the associated enterprise based on the risks and functions performed. The outcome is the arm’s length price.

Typically, the markup in the cost plus method is calculated after considering both direct and indirect costs related to production or supply. However, the operating expenses of an enterprise, such as overhead expenses, are not included in this markup.

Example: Associated Enterprise-A, a computer manufacturer based in Thailand, produces computers under a contract for Associated Enterprise B. Associated Enterprise B provides instructions to Associated Enterprise-A regarding the quantity and quality of computers to be manufactured.

Associated Enterprise-A is assured of its sales to Associated Enterprise B and assumes little to no risk.

Let’s assume the Cost of Goods Sold is INR 50,000. Additionally, assume that the arm’s length markup that Associated Enterprise-A should earn is 40%.

The resulting arm’s length price between Associated Enterprise-A and Associated Enterprise B is INR 70,000 (i.e., INR 50,000 x (1 + 0.40)).

🇮🇳 Transfer Pricing in the Indian Context

Under Section 92 to 92F of the Income Tax Act, 1961, transfer pricing regulations apply to:

- International transactions between two or more associated enterprises.

- Specified domestic transactions exceeding ₹20 crore.

- Documentation requirements as per Rule 10D.

- Arm’s Length Price (ALP) principle is mandatory.

The Indian tax authorities place significant emphasis on transfer pricing audits. Non-compliance could result in adjustments, interest, and penalties.

🧾 Transfer Pricing Documentation

Entities engaging in international or specified domestic transactions must maintain:

- Detailed documentation under Rule 10D.

- Chartered Accountant’s Report in Form 3CEB.

- Benchmarking analysis using databases like Prowess, Capitaline, etc.

Challenges Associated With Transfer Pricing

There are several challenges related to setting transfer prices within organizations:

- Differing Opinions: Organizational divisional managers may have conflicting views on how transfer prices should be determined.

- Resource Intensive: Executing transfer prices and adapting the accounting system to comply with transfer pricing rules require additional time, costs, and manpower.

- Dysfunctional Behavior: Arm’s length prices can lead to dysfunctional behavior among organizational managers.

- Unsuitability for Some Departments: Arm’s length prices may not be equally effective for certain departments, such as service departments, where measurable benefits are not easily quantifiable.

- Complexity in Multinational Settings: Transfer pricing issues are particularly complex in multinational setups.

In the case of domestic transfer pricing, provisions were initially limited to international transactions. However, since April 2013, these provisions have been extended to Specified Domestic Transactions (SDTs) from the assessment year 2013-14. SDTs include:

– Expenditures involving payments to directors, their relatives, or entities where a director or the company holds a voting interest exceeding 20%.

– Transactions related to goods or services provided in specific deduction sections.

– Transactions between entities in tax holiday areas and those in non-tax holiday areas under the same management structure.

– Transactions involving transfer of goods and services from units in special economic zones, free trade zones, or export-oriented units to other units under the same management at non-market prices.

These transactions are considered SDTs only if their aggregate value exceeds INR 5 crore.

Disclaimer: The materials provided herein are for informational purposes only and do not constitute legal, financial, or professional advice. Consult relevant laws and experts before acting on this information. Neither the author nor K M GATECHA & CO LLP is liable for any inaccuracies or omissions. This material is purely educational and not an advertisement or solicitation.

Table of Contents

Toggle