Rationalisation of the provision of Charitable Trust and Institutions

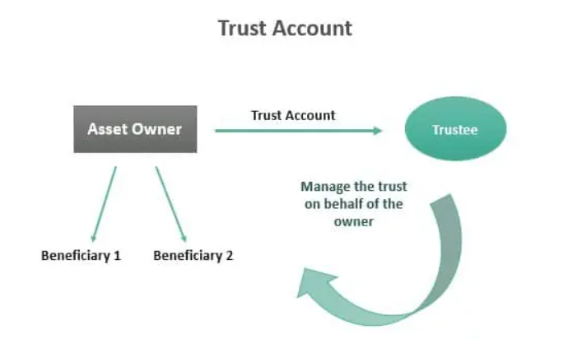

The income earned by funds, institutions, trusts, universities, educational institutions, hospitals, or medical institutions falling under sub-clause (iv), sub-clause (v), sub-clause (vi), or sub-clause (via) of clause (23C) of section 10, or those registered under section 12AA or 12AB of the Act, is exempt provided they meet the conditions specified across different sections. This exemption applies to these trusts or institutions under two different regimes –

(i) The regime applies to any fund, institution, trust, university, educational institution, hospital, or medical institution mentioned in sub-clause (iv), sub-clause (v), sub-clause (vi), or sub-clause (via) of clause (23C) of section 10 (from now on referred to as a trust or institution under the first regime); and

(ii) The regime applies to trusts registered under section 12AA/12AB (after this designated as a trust or institution under the second regime).

The proposed Finance Bill aims to streamline and rationalize the provisions of both exemption regimes by-

(I) Guaranteeing their efficient monitoring and enforcement;

(II) Establishing uniformity in the provisions of the two exemption regimes; and

(III) Offering clarification on taxation in specific situations while ensuring their effective monitoring and implementation.

- Following the amendments made in the past few years, certain consequential changes are also proposed. All the outlined proposals are discussed below:-

- Guaranteeing the efficient monitoring and implementation of the two exemption regimes.

3.1. The trusts or institutions under both regimes must maintain books of account.

- a) If the total income of any trust or institution under the second regime, as calculated under this Act without considering the provisions of section 11 and section 12 of the Act, surpasses the maximum non-taxable income amount in any given year, it is mandatory for them to undergo an audit of their accounts. A similar requirement is present for trusts or institutions under the first regime as stated in the tenth proviso to clause (23C) of section 10 of the Act.

- b) However, the Act currently lacks a specific provision mandating trusts or institutions to maintain books of accounts. To ensure proper implementation of both exemption regimes, a proposal has been put forth to amend clause (b) of sub-section (1) of section 12A of the Act and the tenth proviso to clause (23C) of section 10 of the Act. This amendment suggests that if the total income of the trust or institution under both regimes, without considering the provisions of clause (23C) of section 10 or section 11 and 12, exceeds the maximum non-taxable amount, the trust or institution must maintain books of account and other documents in a prescribed form, manner, and location.

c) These modifications will come into effect from 1st April 2023, and will thus apply to the assessment year 2023-24 and all the following assessment years.

c) These modifications will come into effect from 1st April 2023, and will thus apply to the assessment year 2023-24 and all the following assessment years.

Disclaimer: The materials provided herein are for informational purposes only and do not constitute legal, financial, or professional advice. Consult relevant laws and experts before acting on this information. Neither the author nor K M GATECHA & CO LLP is liable for any inaccuracies or omissions. This material is purely educational and not an advertisement or solicitation.

Table of Contents

Toggle