Filing your Income Tax Return (ITR) correctly is crucial, and understanding which form to use can make the process easier. Here’s a simple guide on the types of ITR Form for FY 2023-24 (AY 2024-25).

What is ITR?

An Income Tax Return (ITR) is a document where taxpayers report their income and taxes paid to the Income Tax Department. The department has introduced seven ITR forms, each tailored to different income sources and categories of taxpayers, such as individuals, HUFs (Hindu Undivided Families), and companies. It is essential to file the correct ITR form before the due date.

Why Should You File ITR?

Filing ITR is beneficial for several reasons:

- Claiming tax refunds

- Reporting foreign income or investments

- Facilitating visa or loan applications

- Mandatory for companies and firms, regardless of profit or loss

- Carrying forward losses from business or capital gains

When is Filing ITR Mandatory?

You must file ITR if your gross total income exceeds the basic exemption limit under the tax regime:

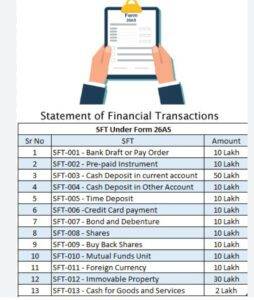

- Deposit in Current Account: If you have deposited more than Rs. 1 crore in one or more current bank accounts, you must file a tax return. This requirement does not apply to deposits in a post office current account.

- Deposit in Savings Account: If your total deposits exceed Rs. 50 lakh in one or more savings bank accounts, you are required to file a tax return.

- Foreign Travel Expenses: If you have spent over Rs. 2 lakh on foreign travel, either for yourself or someone else, you must file a tax return.

- Electricity Bill: If your electricity expenses exceed Rs. 1 lakh in a year, you are required to file a tax return.

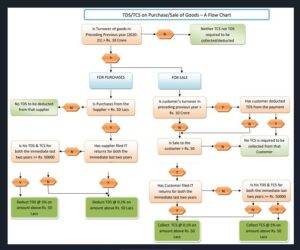

- TDS/TCS Exceeds Rs. 25,000: If the tax deducted or collected at source (TDS/TCS) is more than Rs. 25,000 in the previous year, you must file a tax return. For senior citizens (60 years and above), this limit is Rs. 50,000.

- Business Turnover: If your business has a total turnover or gross receipts exceeding Rs. 60 lakh in the previous year, you are required to file a tax return.

- Professional Income: If you are a professional with gross receipts exceeding Rs. 10 lakh in the previous year, you must file a tax return.

Age Group | Basic Exemption Limit |

For individuals below 60 years | Rs 2.5 lakh |

For individuals above 60 years but below 80 years | Rs 3.0 lakh |

For individuals above 80 years | Rs 5.0 lakh |

Who is Exempt from Filing Income Tax Returns?

The central government has the authority to exempt certain classes of people from filing income tax returns, in addition to the existing exemptions. These include individuals whose total income is below the basic exemption limit and non-residents who do not have income originating from India.

However, as of now, the government has not issued any new notifications granting such exemptions.

Types of ITR Forms

ITR-1 (Sahaj)

ITR-1 is for resident individuals with:

- Income from salary or pension

- Income from one house property

- Income from other sources (excluding lottery or horse race winnings)

- Agricultural income up to Rs. 5,000

Who cannot use ITR-1?

- Income exceeding Rs. 50 lakh

- Agricultural income above Rs. 5,000

- Capital gains or business income

- Owning foreign assets

ITR-2

ITR-2 is for individuals or HUFs with:

- Income from salary/pension

- Capital gains or house property income

- Foreign income or assets

- Director in a company or holding unlisted shares

Who cannot use ITR-2?

Those with business or professional income need to file ITR-3 or ITR-4.

ITR-3

ITR-3 is for individuals or HUFs with income from:

- A proprietary business or profession

- Partner’s income from a firm

- Those not eligible for ITR-1, ITR-2, or ITR-4

ITR-4 (Sugam)

ITR-4 is for individuals, HUFs, and firms with presumptive income from:

- Business under section 44AD or 44AE

- Professional income under section 44ADA Income should not exceed Rs. 50 lakh.

Who cannot use ITR-4?

- Income exceeding Rs. 50 lakh

- More than one house property

- Holding foreign assets or shares

ITR-5

ITR-5 is for firms, LLPs, AOPs (Association of Persons), BOIs (Body of Individuals), and investment funds.

ITR-6

ITR-6 is for companies, except those claiming exemptions under section 11 (for charitable or religious purposes).

ITR-7

ITR-7 is for individuals or entities required to file under specific sections, including political parties, trusts, educational institutions, and business trusts.

Conclusion

Choosing the correct ITR form depends on your income source, business type, and financial transactions during the year. Filing the right form ensures accurate reporting and avoids penalties.

If you need further guidance on selecting the right ITR form, read our detailed guides on each form, or consult a tax professional for assistance.

Frequently Asked Questions

Is a senior citizen exempt from filing an income tax return?

The Income-tax Act, 1961 does not exempt senior or very senior citizens from filing income tax returns. However, to provide relief to senior citizens aged 75 years or above, the Finance Act, 2021 introduced Section 194P.

Under this section, if a senior citizen maintains a bank account where they receive pension income, the bank is required to deduct tax. This applies if the senior citizen is a resident, aged 75 or older, and earns only pension and interest income from the account maintained with the bank. If tax is deducted by the bank, the senior citizen is not required to file an income tax return for that year.

If I have incurred a loss during the Financial Year 2023-24, do I need to file an IT return?

If you are an individual, you do not need to file an income tax return in case of a loss. However, self-employed individuals or those in business are required to file returns even if they incur a loss in a particular financial year.

Who is eligible to opt for the presumptive taxation scheme for filing ITR-4?

The presumptive taxation scheme offers relief to small taxpayers by simplifying the process of filing returns for those with a turnover not exceeding Rs. 2 crore. Under this scheme, taxable income is calculated at a predetermined rate on total turnover.

What documents do I need to file along with ITR-1?

No documents are required to be attached while filing ITR-1. However, it is advisable to download your AIS, Form 16, house rent receipts (if applicable), and investment or premium receipts (if applicable) to ensure accuracy while filing the return. These documents also serve as proof in case of an audit or inquiry.

Which ITR should I file if I have capital gains?

If you have income from capital gains, you should file ITR-2.

What is the difference between ITR-1 and ITR-2?

ITR-1 is for individuals with income from salaries and total annual income below Rs. 50 lakh. ITR-2 is for individuals with capital gains or income from more than one house property.

Which ITR should housewives file?

Housewives can file the same ITR forms applicable to salaried individuals. ITR-1 is suitable if the total annual income is less than Rs. 50 lakh and there is income from only one house property. ITR-2 should be filed if income exceeds Rs. 50 lakh or there are capital gains or more than one house property.

Which ITR form should salaried employees file?

The ITR form depends on the individual’s total income and its sources:

- ITR-1: If total income is less than Rs. 50 lakh and the individual has income from only one house property.

- ITR-2: If the individual has income from more than one house property or capital gains.

- ITR-3: If the individual has income from business or profession in addition to salary.

- ITR-4: For individuals who receive a salary and have additional income from freelancing or part-time business.

Table of Contents

Toggle