TDS on purchase of goods u/s 194Q

TDS is Tax Deducted at Source is a tax implemented so that the tax can be collected from the source of income. The deductee or the person who levies the tax is liable

to pay this TDS to the Income Tax Department. There are various situations and incidences where TDS is to be levies one of those incidences is “TDS on purchase of goods u/s 194Q”.

TDS on Purchase of Goods: –

TDS on purchase of goods comes under Section 194Q of Income Tax Act. The TDS is to be deposited to the Income Tax Department before the 7th of the month following the payment.

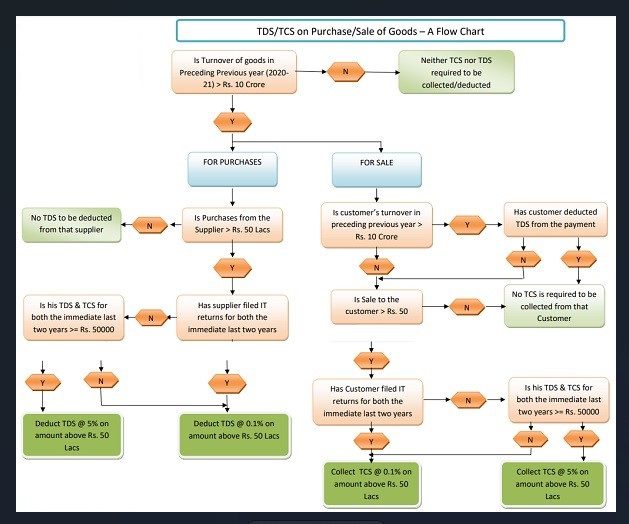

TDS is deducted by buyer when making payment to seller when the total value of goods exceeds INR 50,00,000/- in the current fiscal year and the buyers “Business Turnover” is INR 10 crores or above in the preceding fiscal year. The tax is to be deducted on amount that is over and above 50 lakhs.

The rate of TDS is 0.1% when seller furnish his PAN and 5% when seller is unable to furnish his/her PAN card.

So, if a buyer purchases goods aggregating INR 6.8 lakhs from a seller in July 2021 and total sales in the fiscal year previously were INR 49.2 lakhs, then TDS to be deducted while making payment will be INR 600/- if PAN is furnished otherwise INR 3,000/-. The TDS is to be deposited maximum by 7th of August 2021.

Exceptions to TDS on purchase of goods u/s 194Q rule

- The year in which the business is incorporated or is started,

- When the total sales have not crossed INR 50lakhs,

- When business turnover of buyer was not INR 10crores or more in previous year,

- Non-resident buyer,

- Transactions in securities and commodities done through recognized stock exchanges and clearing corporations,

- Transactions in electricity, renewable energy certificates and energy saving certificates done through power exchanges,

- Transactions on which TDS is deductible under other provisions on Income Tax.

Other clarifications for TDS on purchase of goods u/s 194Q

- Business turnover does not include interest income, capital gains or rental income.

- The TDS provisions are applicable from 1st of July 2021. So, if the purchases have exceeded INR 50,00,000/- before that then TDS is applicable from 1/7/2021.

- The GST amount may be excluded in calculation of purchases,

- The TDS is to be deducted at time of payment and not purchase,

- If the amount is paid in advance, then the purchase amount calculation is to be done including GST,

- In case of advance payment, the TDS is to be deducted at the time of payment as TDS is recorded at the time of payment,

- TDS is to be deposited on 7th of the following month of payment except for March for which the date of depositing TDS is 30th April,

- The seller can claim this deduction while filing their Income Tax Returns.

Frequently asked questions of TDS on purchase of goods u/s 194Q

Deduction of TDS is mandatory only if total aggregate of purchase is more than INR 50,00,000/- and business turnover of buyer is more than INR 10 crores in previous fiscal year.

The responsibility of deducting as well as depositing TDS is on the buyer of goods.

The penalty on nonpayment of TDS is calculated from date of deduction:

- 1% interest per month for partial nonpayment,

- If complete amount is not paid then 1.5% interest per month.

If the buyer does not deposit TDS after deducting it, then in Traces there which be mismatch for seller in claiming the TDS, an inquiry will be made by I.T. department and according to the outcome of inquiry the TDS will be recovered from buyer with interest.

Yes, refund application can be filed to claim a refund in TDS.

Any seller can inquire about the TDS deposit in Form 26AS on TRACES website.

1% of transaction value above 50,00,000/- if PAN card of seller is furnished otherwise 5%.

Table of Contents

Toggle