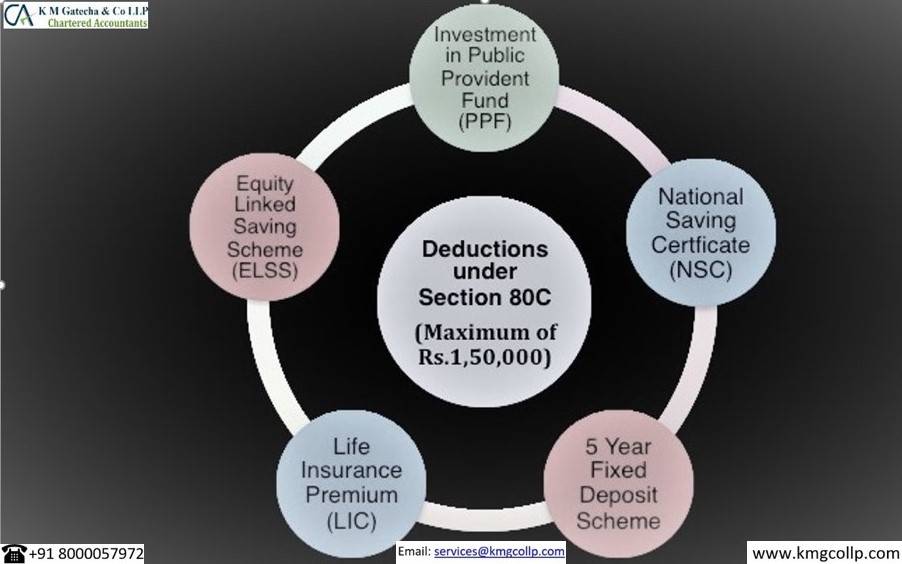

Section 80C is an income tax deduction that helps you to reduce the tax. Each financial year, we look for ways to save our taxes at the time of filing of income tax returns. But first, we need to know about the tax Deductions under 80C after that you can claim as a taxpayer. It covers specified investment and payment options which can reduce your taxable income up to Rs 1.5 lakhs. Here are some tax savers other than Section 80C to help you to save more taxes. Some tax savers and expenses such as investment in public provident fund, NSC, ELSS, Life insurance policy including tuition fees for children. The last date to save taxes for the end of the financial year 2021-22 is March 31, 2022. If you want to save your taxes lets understand the eligible investments first

Investment eligible For Tax Deduction Under Section 80C-

- Investment in Public Provident Fund (PPF): – PPF scheme is a long-time investment scheme followed by the government of India. A PPF account can open in their own name or in the name of the minor child of Resident Indian Individual. PPF account has the maturity period of 15 years, but it also extended to 5 years where partial withdrawal is allowed after 7 years. The rate of interest is 7.9% p.a. The minimum investment limit is Rs 500, and the maximum limit is 1.5 lakhs.

- Purchase of National Saving Certificate (NSC): – National Saving Certificate investment is also eligible for deduction under Section 80C in the year when they are bought. These can be bought from designated post office. this scheme is for 5 years, and interest earned is annually. this interest earned is also taxable.

- 5 Year Fixed Deposit Scheme (FDR): – All resident Indian individual can open a fixed deposit tax-saving bank account and senior citizen is also eligible. The Maturity period for this scheme with tenure of 5 years and a person is not allowed to break this fixed deposit before maturity. The minimum investment is not less than Rs 1000 and Rs 15 lakh is the maximum limit.

- Life Insurance Premiums (ULIP): – this is a life insurance policy which is eligible for deduction under section 80C. There is no such limit for making investment in the ULIP, but the premium should not be more than 10% of the sum assured for taking the benefit of tax under section 80C.the maturity period for this scheme with tenure of minimum of 5 years and tax benefits on investment up to Rs. 1.5 lakhs. An investment such as mutual fund and bonds and stocks are eligible for the deduction under 80C.

- Equity Linked Saving Scheme (ELSS): – ELSS or Equity Linked Saving scheme is a type of mutual fund investment which is eligible for deduction under 80C if the investment made in ELSS fund during the financial year. The maturity period for this scheme is about 3 year and the minimum investment is not less than Rs 500 and there is no upper limit prescribed.

- Sukanya Samriddhi Scheme (SSS): – Resident Individual parents having a girl child can invest in this scheme till the age of 10. The minimum limit of deposit in this account is not less than Rs 250 annually and the maximum limit is about Rs 1,50,000. The amount is required to be deposited for 15 years. After 21 years, this account will mature.

Frequently Asked Questions:-

It allows for a maximum deduction of up to Rs. 1.5 lakh every year from an investor’s total taxable income. Section 80C is applicable only for individual taxpayers and Hindu Undivided Families. Corporate bodies, partnership firms, and other businesses are not qualified to avail tax exemptions under Section 80C.

The total amount that can be claimed under sections 80C, 80CCC and 80CCD (1) combined is `150,000.

To save tax, make an investment of ₹ 1.5 lakh under Section 80C. Buy medical insurance and claim a deduction up to ₹ 25,000 (₹ 50,000 for senior citizens) for medical insurance premium paid under Section 80D. Also, investment of up to ₹ 50,000 in NPS could help you with additional tax savings under Section 80CCD (1B).

Table of Contents

Toggle