You can cancel your GST registration if your business is no longer subject to GST rules, you are closing down your business, or if a tax officer initiates the cancellation. This article will guide you through the various types of cancellations and the complete process.

Meaning of Cancellation of GST Registration

Cancellation of GST registration means that the taxpayer will no longer be registered under GST. As a result, they will not have to pay or collect GST, claim input tax credits, or file GST returns.

Consequences of GST Registration Cancellation

- The taxpayer will no longer be required to pay GST.

- For certain businesses, GST registration is mandatory. If the registration is cancelled but the business continues to operate, it constitutes an offence under GST law, and substantial penalties will apply.

Who Can Cancel the GST Registration?

The infographic below provides guidance on who can initiate the cancellation of GST registration:

- The Taxpayer: If GST rules no longer apply to their business or if they are shutting down.

- The Tax Officer: If there are grounds for cancellation as per GST laws.

Also, check here for GST registration.

Application for Cancellation of Voluntary Registrations

Previously, taxpayers who voluntarily registered under GST could only apply for cancellation after one year from the registration date. This provision has now been rescinded, allowing for cancellation at any time.

Cancellation of GSTIN for Migrated Taxpayers

Individuals registered under previous indirect tax laws were required to migrate to GST, even if they were not liable for GST registration. For instance, the threshold for VAT in most states was ₹5 lakhs, and for Service Tax, it was ₹10 lakhs, whereas under GST, it is ₹20 lakhs*. However, registration is mandatory for inter-state suppliers, except for service providers.

*The threshold is ₹40 lakhs for the supply of only goods in some states or ₹10 lakhs in certain special category states/Union Territories.

Such taxpayers must submit an application electronically using form GST REG-29 on the GST portal. The proper officer will then conduct the necessary enquiry and cancel the registration if appropriate.

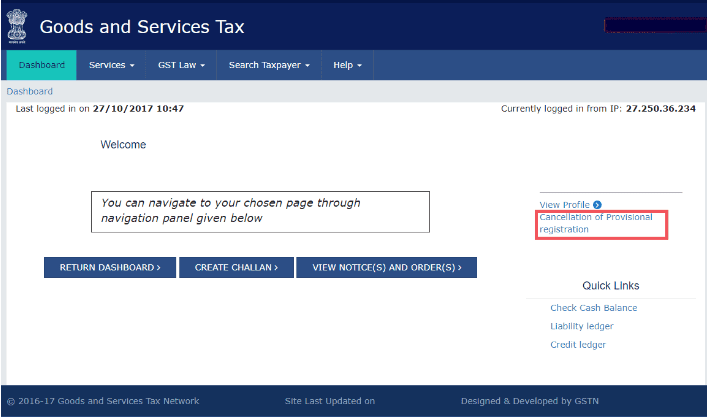

Below are the steps for cancelling GSTIN by migrated taxpayers on the GST Portal:

Step 1: Log in to the GST Portal and click on “Cancellation of Provisional Registration.”

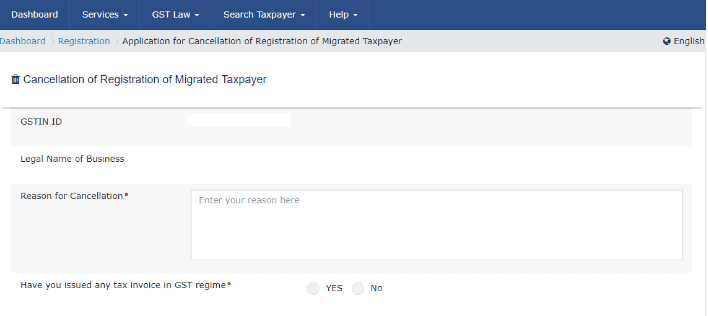

Step 2: Once on the Cancellation page, your GSTIN and the name of your business will be displayed automatically.

You will be prompted to provide a reason for cancellation.

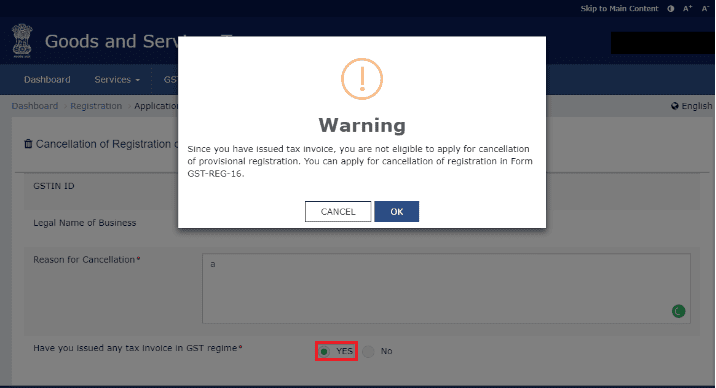

You will be asked whether you have issued any tax invoices during the month.

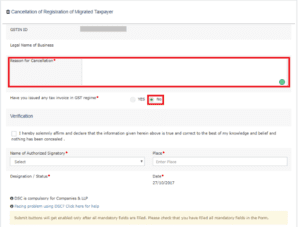

Simply fill in the details of authorized signatories and their location. If you are a proprietor or a partnership firm, sign off with EVC. LLPs and Companies must sign with DSC.

Note: Taxpayers who have not issued tax invoices can avail the above service. If the taxpayer has issued any tax invoices, then FORM GST REG-16 needs to be filed. Refer below.

Cancellation by taxpayer (Other than Migrated)

Why does a taxpayer wish to cancel their registration?

- The business has been discontinued.

- The business has been fully transferred, amalgamated, demerged, or otherwise disposed of. The transferee (or the new company resulting from amalgamation/demerger) must register. The transferor will cancel its registration if it ceases to exist.

- There is a change in the constitution of the business. For example, a private limited company has changed to a public limited company.

From January 1, 2022, CBIC made Aadhaar authentication mandatory to apply for the revocation of cancelled GST registration under CGST Rule 23 in REG-21.

Forms for cancellation:

Those unable to follow the above method must file an application for cancellation in form GST REG 16. The legal heirs of the deceased taxpayer will follow the same procedure as below.

The application for cancellation must be made in form GST REG 16 and include the following details:

- Details of inputs, semi-finished, finished goods held in stock on the date of applying for cancellation of registration.

- Liability thereon.

- Details of the payment.

The proper officer must issue an order for cancellation in form GST REG-19 within 30 days from the date of application. The cancellation will be effective from a date determined by the officer, and the taxable person will be notified.

Cancellation by tax officer

Why will the officer cancel registration?

The registration can be cancelled if the taxpayer:

(a) Does not conduct any business from the declared place of business.

(b) Issues invoices or bills without the supply of goods/services (i.e., in violation of the provisions).

(c) Violates anti-profiteering provisions (for example, not passing on the benefit of ITC to customers).

With effect from January 1, 2021:

(d) Utilizes ITC from electronic credit ledger to discharge more than 99% of the tax liability for specified taxpayers violating Rule 86B – with the total taxable value of supplies exceeding Rs.50 lakh in the month, with some exceptions.

(e) A taxpayer who cannot file GSTR-1 due to GSTR-3B not being filed for more than two consecutive months (one quarter for those who opt into the QRMP scheme).

(f) Avails input tax credit in violation of the provisions of section 16 of the Act or the rules.

Procedure:

If the proper officer has reasons to cancel the registration of a person, they will send a show-cause notice to such person in form GST REG-17.

The person must reply in form REG–18 within 7 days from the date of service of the notice why their registration should not be cancelled.

If the reply is found to be satisfactory, the proper officer will drop the proceedings and pass an order in the form GST REG–20.

If the registration is liable to be cancelled, the proper officer will issue an order in the form GST REG-19. The order will be sent within 30 days from the date of reply to the show cause.

Revocation of cancellation of registration

What is revocation of cancellation?

Revocation refers to the official reversal of a decision or promise. Revocation of cancellation of registration means that the decision to cancel the registration has been reversed, and the registration remains valid.

When is revocation of cancellation applicable?

Revocation of cancellation is applicable only when the tax officer has cancelled the registration of a taxable person on their own motion. The taxable person can apply to the officer for revocation of cancellation within thirty days from the date of the cancellation order.

Procedure

A registered person can submit an application for revocation of cancellation in form GST REG-21 if their registration has been cancelled suo moto by the proper officer. This application must be submitted within 30 days from the date of service of the cancellation order at the Common Portal.

If the proper officer is satisfied, they can revoke the cancellation of registration by an order in form GST REG-22 within 30 days from the date of receipt of the application. The reasons for revocation of cancellation of registration must be recorded in writing.

The proper officer can reject the application for revocation by an order in form GST REG-05 and communicate the same to the applicant. Before rejecting, the proper officer must issue a show-cause notice in form GST REG–23 for the applicant to show why the application should not be rejected. The applicant must reply in form GST REG-24 within 7 working days from the date of the service of notice.

The proper officer will take a decision within 30 days from the date of receipt of clarification from the applicant in form GST REG-24.

Note: Application for revocation cannot be filed if the registration has been cancelled because of the failure to file returns. Such returns must be furnished first along with payment of all dues amounts of tax, interest & penalty. We provide the GST audit services.

Can the business register for GST after cancellation?

Yes, there is no restriction on taking GST registration once it has been cancelled except where it was cancelled by the tax officer.

For more information, read a host of articles by ClearTax:

- GST Registration Cancellation Online

- Procedure for cancellation of GST registration by tax officer

- All you need to know about the revocation of GST registration cancelled

- Cases of Suspension of GST registration and to-dos

- Filing of GSTR-10 Final return under GST

Disclaimer: The materials provided herein are for informational purposes only and do not constitute legal, financial, or professional advice. Consult relevant laws and experts before acting on this information. Neither the author nor K M GATECHA & CO LLP is liable for any inaccuracies or omissions. This material is purely educational and not an advertisement or solicitation.

Table of Contents

Toggle