On February 1, 2020, Finance Minister Nirmala Sitharaman presented the Annual Budget 2020. The new tax regime was first implemented in the preceding budget. In this article, you will learn about the numerous rules relating to the ‘Form 10IE- New Tax Regime, Taxability, Time-Limit’. Individuals and HUF are the only ones eligible for this new tax regime, and they must opt in using Form 10IE.

Taxpayers will pay less tax on their total income under the new tax regime. Furthermore, taxpayers are no longer eligible for the deductions and tax benefits that were previously available under the former tax system.

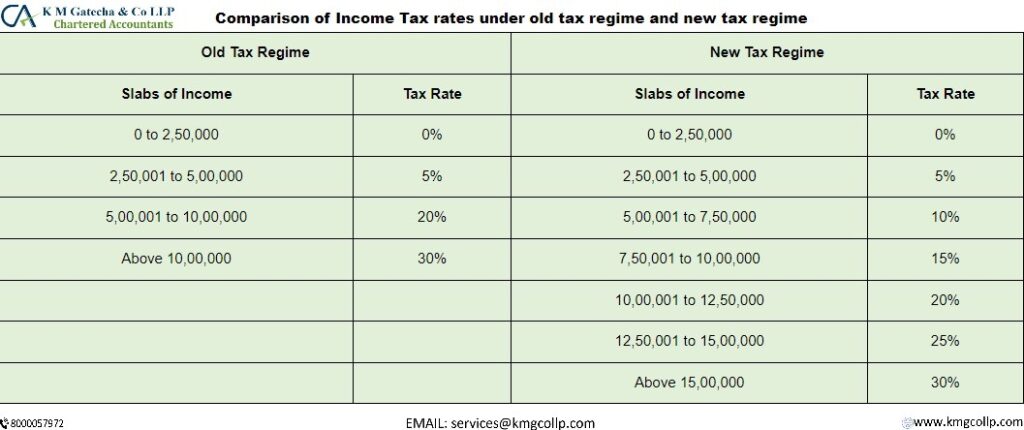

In the Finance Act, 2020, ITR filers must fill out Form 10IE to declare their preference for the new tax regime. In this essay, we will go over the specifics of Form 10IE. The tax on your income was computed according to the old tax slabs under the old tax regime. The applicable tax slabs apply to various levels of income.

Comparison of Income Tax rates under old tax regime and new tax regime

Although the new tax system offers lower tax rates, most deductions and tax benefits from the old/existing tax regime are no longer available. LTA, HRA, the standard deduction under Section 80TTA/80TTB, professional tax, and entertainment allowance on salary, among other deductions and exemptions, are no longer available under the new tax regime. The basic difference between the old and new tax regimes is that the former has lower income tax rates, and the latter has more tax slabs. Either the old/existing tax regime or the new tax regime will be available to you. Before you file your income tax returns for the relevant financial year, you must make this decision.

Time Limit for Filing Form 10IE:

If you have a business income, you can file Form 10IE before the income tax return due date, which is July 31, or any other date set by the government of India. You can file Form 10IE before or at the time of filing your income tax returns if you are a salaried employee.

Form 10IE- New Tax Regime Contents

The basic details that must be filled in while filing Form 10IE are listed below.

- The individual’s name/HUF

- Date of birth/date of incorporation

- Nature of business/profession

- If the taxpayer possesses any unit in an IFSC (International Financial Service Centre) as indicated in sub-section (1A) of Section 80LA, confirm in ‘yes/no’. If the answer is yes, the unit’s specifications must be provided.

- Details of a previously filed Form 10IE

- Declaration

- Confirmation of revenue under ‘Profit or gains from business and profession’ for the person or HUF.

- PAN details

- Address

Switching between Old Tax Regime & New Tax Regime

Business income

Individuals with business income do not have the option to select between the new and old tax regimes every year. They can only switch back to the old tax regime once during their lifetime once they have chosen the new tax regime. They will not be able to choose a new tax regime once they have switched back.

People with business income may need to fill out Form 10-IE twice: once to use the new tax system and again to revert to the old system.

No Business income

Every year, a person with a salary income but no business income can select between the old and new tax regimes. Individuals who do not have a business or professional income are not required to file Form 10IE. Instead, they can simply select the 115BAC option when submitting ITR 1 or 2.

What are the eligible deductions & exemptions available in the new tax regime?

The taxpayer can choose the following deductions & exemptions if he opts for the new tax regime:

- Exemption against gratuity u/s 10(10)

- Exemption against commuted pension u/s 10(10A)

- Exemption on maturity proceeds of LIC u/s 10(10D)

- Deduction under section 80CCD (2) w.r.t. contribution by the employer to NPS

- Interest on housing loan for let-out property

Deduction u/s 80JJAA with respect to additional employee cost to the employer

Frequently Asked Questions

Can 10IE be filed after the due date?

If you have a business income, you can file Form 10IE before the income tax return due date, which is July 31, or any other date set by the Indian government.

Yes, it is mandatory to file Form 10IE if you want to opt for a new tax regime and have Income under the head “Profits and Gains of Business and Profession.” Form 10IE must be filed before filing your Income Tax Return.

From when is the new tax regime applicable?

Beginning April 1, 2020, individual salaried taxpayers will have the option of continuing with the old tax regime and taking advantage of deductions/tax exemptions such as section 80C, 80D, HRA, and LTA tax exemptions, or opting for the new tax regime and foregoing approximately 70 deductions and tax exemptions.

Disclaimer: The above information is provided only for educational purposes. Readers are advised to exercise caution and seek professional counsel before relying on the above information. K M Gatecha & CO LLP is not liable for any loss or harm incurred by readers who take action based on the information provided in this article.