GST on rental income from commercial property

GST on Rental income : - In this article we will discuss about GST on rental income from commercial property. Any person/ individuals receiving income from the residential property like shop/factory…

GST on Rental income : - In this article we will discuss about GST on rental income from commercial property. Any person/ individuals receiving income from the residential property like shop/factory…

In this article we have discussed all about HUF in India.The business carried out by the members of a Hindu undivided family as joint Hindu family business. HUF is a…

How to claim exemptions from Long Term Capital Gains Long Term Capital Gains are defined as profits on sale of assets (movable or immovable) which have been held for: 3…

TDS on purchase of goods u/s 194Q

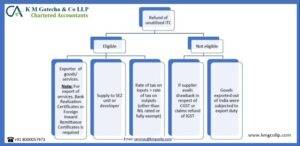

GST refund is a procedure in which a taxpayer wants to get the amount, which is in excess of the GST liability, refunded to his/her account.

Tax on property sale in India attract various taxes such as Gains, Cess and TDS which is to be calculated and paid while selling the property. These taxes are to…

House Rent Deduction in Income taxHouse is one of the basic needs of any individual. Thus, the Government of India has made an allocation for deduction of rent paid by…

Mandatory compliance for Private Limited Company In this article we have discussed about Mandatory compliance for Private Limited Company. Mandatory compliance for Private Limited Company The compliances…

Taxation for NRI in India In this article we have covered taxation for NRI in india which includes definitions of NRI, taxation rules for NRI, Income tax deductions for NRI.NRI…

Cash Deposit Limit in Savings Account as per Income Tax: A Comprehensive Guide Cash Deposit Limit in Savings Account as per Income Tax: A Comprehensive Guide In this article we…

In this article we will discuss about benefits of filing itr and Who is required to do compulsory filing of ITR? In following cases filing of ITR is mandatory.Thus in following case…

In the union budget 2020 finance minister extended faceless assessment proceedings to the CIT appeals also. Hence this also led to amendments in section 250 of the income tax act…

5 Must know about charitable trust Section 11 and section 12 of Income Tax Act 1961 deal with taxation of charitable and religious trust. Today we have discussed few important…

Today we have explained taxation of gifts under Income Tax Act 1961 from relative. People are usually unaware of the taxation of the gifts which is most popular topic for…