NRIs while selling their house properties in India must pay tax on the Capital Gains. The tax payable on the gains depends on whether it is a short-term or a long-term capital gain. This article will explore all about “Income tax implications for NRI selling property in India.” With the upcoming budget, Indians living abroad are looking for more clarity on the legal definition of non-resident Indians (NRI). Many NRIs own immovable property in India, which is either acquired by themselves or inherited from parents. “When they want to sell such property, the buyer must deduct TDS at 20.80% on the sale price.

How Do You Deduct TDS On Purchase of Property From NRI?

TDS u/s 195: A buyer can deduct TDS (tax deducted at source) on the purchase of property from NRI on the amount of total value of the sale.

Long-term capital gains are determined when the property is sold after 2 years of holding period, while short-term capital gains are calculated or determined when the property is sold before 2 years of holding period.

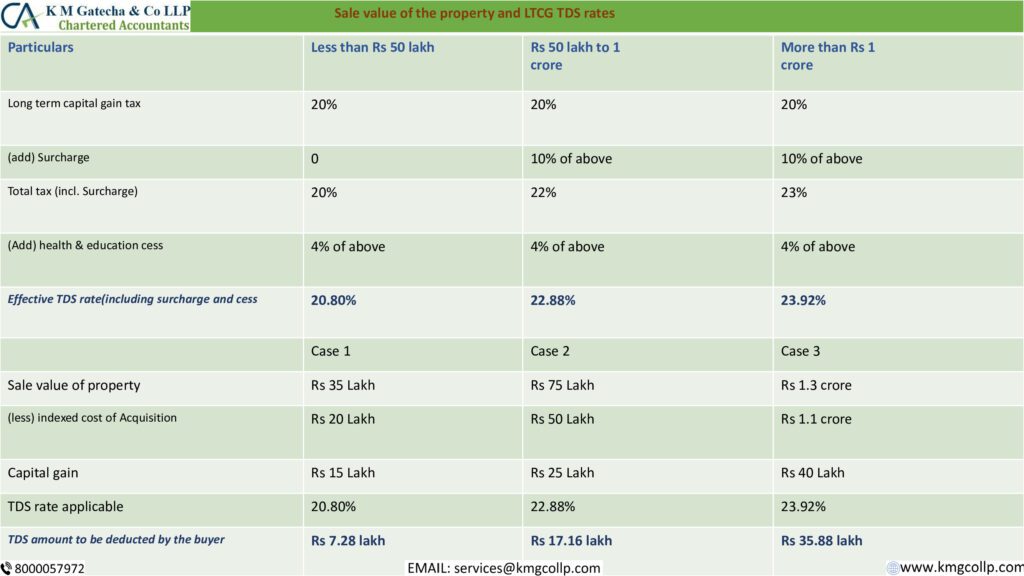

As per section 195, the TDS on property purchase from NRI with long term capital gains is as follows:

- For property priced at less than Rs. 50 lakhs, the effective TDS rate is 20.80%.

- For property priced between Rs. 50 lakhs to Rs. 1 crore, the effective TDS rate is Rs. 22.88%.

- For property priced over Rs. 1 crore, the effective TDS rate is Rs. 23.92%.

If the property sale gives long-term capital gains to the seller, then the applicable tax rate is 20% of the sale value of the property. If the transaction is based on short-term capital gains, then the TDS is applicable at 30% of the sale value. To reduce the TDS on the Sale of Property by NRI, the NRI is required to file an application in Form 13 with the Income Tax Department for issuance of a Certificate for Nil/ Lower Deduction of TDS. This Certificate helps the NRI in reducing the TDS Liability to a great extent and therefore, most NRI opts for this certificate.

The buyer of the property deducts TDS on the purchase of property from NRI with respect to section 195 within an earlier date of payment or date of credit of income.

Section 54, 54EC, 54F: Capital Gain Tax Exemption in 2022:

The exemption can be claimed only in respect of one residential house property purchased/constructed in India. To claim an exemption under section 54, 54EC, 54F the taxpayer should purchase another house within a period of one year before or two years after the date of transfer of the old house.

- Section 54: Old Asset: Residential Property, New Asset: Residential Property

- Capital Gains Account Scheme

- Section 54EC: Old Asset: Any Asset, New Asset: Specified Bonds

- Section 54F: Old Asset: Any Asset, New Asset: Residential House

In this case, the old house is transferred on 25th April 2022, hence, he must purchase another house within a period of 2 years from 25th April 2022; alternatively, he can construct another house within a period of 3 years from 25th April 2022.

We are prominent Chartered Accountants in Ahmedabad and designated partners in K M GATECHA & CO LLP. We offer services in Ahmedabad and other major cities in India. In case you are puzzled about the Income-tax implications for NRI selling property in India, feel free to consult the income tax experts at K M GATECHA & CO LLP. You can get comprehensive assistance and the best services on income tax Returns Filing online and offline. You can also clear your doubts by simply calling us at +91 8000057972 or emailing us the same at services@kmgcollp.comm.

Frequently Asked Questions

When an NRI sells the property, the buyer is liable to deduct TDS @ 20%. In case the property has been sold before 2 years (reduced from the date of purchase) a TDS of 30% shall be applicable.

For a non-resident seller, tax is required to be deducted at source at 20% (plus applicable surcharge and cess) in case of sale of long-term property and at 30% (plus applicable surcharge and cess) in case of sale of the short-term property.

If NRIs file Income Tax Returns (ITR) after the financial year has ended in India, they can claim refunds on the deducted TDS. For an NRI to claim a refund on the TDS deducted, he/she must self-compute their income and tax liability according to existing slab rates.

Table of Contents

Toggle