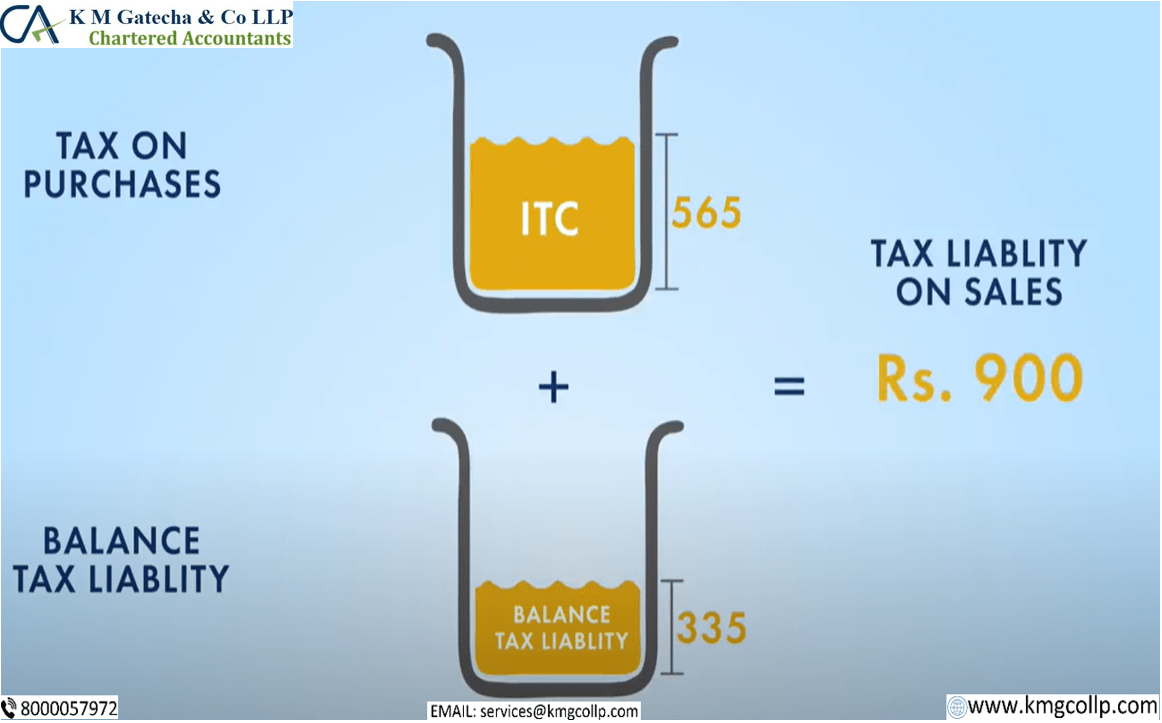

In this article, we have listed as such items, which are not eligible for the input tax credit under GST. But first, we need to understand the term ‘ITC’. ITC stands for Input Tax Credit, which means, at the time of paying tax on output, you can reduce the tax you have already paid on inputs. It is a process of claiming the credit which is paid at the time of purchase of Goods and Services. As per the current update from January 1, 2022, ITC claims will be allowed only if it appears in GSTR-2B .so the taxpayers can no longer claim 5% provisional input tax credit under the CGST rule 36(4).

Cases Where Input Tax Credit under GST Cannot Be Availed

S.NO. | Category of goods and services exceptions |

|

1. | Motor vehicles & conveyances |

|

2. | Food, beverages, Health Services Cosmetic, Plastic Surgery, and others |

|

3. | Sale of membership in a club, health, fitness center |

|

4. | Services of general insurance, servicing, repair, and maintenance |

|

5.

| Rent-a-cab, life insurance, health insurance |

|

6. | Travel benefits |

|

7. | work contract services |

|

8. | composition scheme in GST law |

|

9. | Non-resident taxable person |

|

10.

| Goods/ Services used for personal purposes and not for business purposes |

|

11. | Free samples and destroyed goods | · No ITC is available for goods lost, stolen, destroyed, written off, or given off as gifts or free samples. |

12. | No ITC in fraud cases |

|

13. | Lost or Stolen or Damaged Goods |

|

Frequently Asked questions

- the input tax credit can be claimed only by a person that has a GST registration and has filed the GSTR 2 returns. services. The said goods or services or both should be received. The supplier has made the GST payment that is charged to the government concerning such supply.

- ITC used for business purposes will be declared as eligible ITC and those used for other purposes will not be able to claim as ITC except blocked credit, which is specifically supplied separately. The ITC eligibility is based on whether the same is used for taxable supplies or exempt supplies.

A registered person is entitled to take credit of input tax charged on the supply of goods or services or both to him which are used or intended to be used in the course or furtherance of business, subject to other conditions and restrictions.

The input tax credit shall not be allowed on the said tax component in respect of which depreciation has been claimed.

Table of Contents

Toggle