The old vs new income tax regime are two tax systems for individual citizens in India. New Income tax regime has less tax rate with no deductions.

The old income tax system is the customary income tax system, while the new assessment system was presented in 2020 fully intent on working on the income tax framework and diminishing the taxation rate on individual citizens. While ITR filing everyone has confusion in choosing Old vs New Income tax regime.

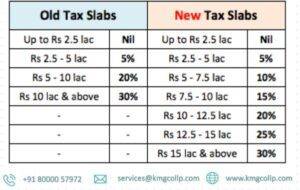

Old income tax slab in India

For the monetary year 2023-24 (Assessment year 2024-25), the personal income tax rate in India for people under the old assessment system are:

Rs. 0 to Rs. 2.5 lakhs-0%

Rs. 2.5 lakhs to Rs. 5 lakhs -5%

5 lakhs to Rs. 10 lakhs – 20%

Above Rs. 10 lakhs – 30%

Under the previous tax system, taxpayers could take advantage of a number of exemptions and deductions to reduce their taxable income and tax burden.

Under the old tax system, Section 80C of the Income Tax Act allowed for one of the most significant deductions. Taxpayers are permitted to claim a deduction of up to Rs. 1.5 lakhs for investments in various instruments like the Equity-Linked Saving Scheme (ELSS), National Savings Certificate (NSC), and Public Provident Fund (PPF). This derivation is especially gainful for citizens who make ventures routinely and can assist with lessening their available pay fundamentally.

Another derivation accessible under the old income tax system is under Segment 80D, which permits citizens to guarantee a derivation for clinical costs caused for them as well as their relatives. This can be a deduction of up to Rs. Rs. 25,000 for individuals 50,000 for senior residents.

Likewise, citizens can guarantee a derivation for interest paid on a home credit for self-involved property under Segment 24 of the Personal Expense Act. The derivation is accessible up to Rs. 2 lakhs for the interest on a home loan, which can contribute to a reduction in taxable income and tax liability.

Taxpayers are also eligible for a number of exemptions in addition to these deductions, such as exemptions for the House Rent Allowance (HRA), Leave Travel Allowance (LTA), and employee gratuity. The taxpayer’s taxable income and tax burden can be significantly reduced by these exemptions.

However, one disadvantage of the old tax system is that it has higher tax rates than the new system. The most elevated charge rate under the old expense system is 30% for people acquiring over Rs. 10 lakhs. To claim deductions and exemptions, taxpayers must also keep track of their investments and expenses, which can be time-consuming.

New Income Tax Regime in India

India’s new tax system was implemented with the intention of reducing taxpayer tax burden and streamlining the structure of the income tax. Taxpayers can choose between the old and new tax system under this system. The new tax system has a lower tax rate than the old one, but there are some conditions and restrictions.

What you need to know about the new income tax regime is as follows:

The following are the individual income tax rate in India under the new tax system for the financial year 2023-24 (assessment year 2024-25):

Up to Rs. 3 lakhs – Nil

Rs. 3lakhs to Rs. 6 lakhs – 5%

Rs. 6 lakhs to Rs. 9 lakhs – 10%

Rs. 9 lakhs to Rs. 12 lakhs – 15%

Rs. 12 lakhs to Rs. 15 lakhs – 20%

Above Rs. 15 lakhs – 30%

Deductions and exemptions in new Income tax regime in India:

Under the new expense system, citizens are not qualified for specific derivations and exclusions, allowances under Segment 80C, Area 80D, and so on. However, taxpayers can still claim certain deductions, such as deductions for contributions made to the National Pension Scheme under Section 80CCD(1B) and interest paid on home loans under Section 24. These derivations are dependent upon a most extreme breaking point, and citizens can’t guarantee some other derivations or exceptions.

Optional regime:

Taxpayers can choose to pay taxes under either the old or new tax system because it is optional. However, in subsequent years, taxpayers who choose the new system cannot switch back to the previous one.

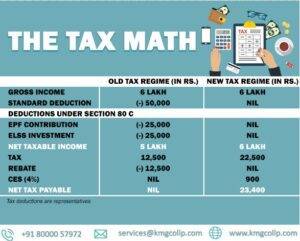

Old vs New Income tax regime ,which Tax regime to choose:

The decision of expense system relies upon individual citizens’ assessment risk and their qualification for allowances and exclusions. The new tax system may be more beneficial to taxpayers with lower incomes who do not have significant investments or expenses that are eligible for deductions and exemptions. Then again, citizens with higher salaries and those with ventures or costs that meet all requirements for derivations and exceptions might find the old income tax system more favourable.

Old vs New Income tax Regime

No exemptions and deductions: The new tax regime does not offer as many exemptions or deductions. Only a few are offered, like the standard deduction, leave travel concession, and tax-free withdrawals from the provident fund.

The government has introduced a standard deduction benefit in the new tax regime for salaried people and pensioners. As per Budget 2023, tax rebates for individuals have been increased, and income up to Rs 7 lakh will be tax-free. People with earnings between Rs 750,000 and Rs 900,000 will have to pay 10 per cent tax.

Switching between old and new tax regime is restricted only for those with income from business or profession. They can switch in only once in lifetime. The change which has happened is from FY24, new tax regime will be the default option available to taxpayers

Owner of this information can be reached at K M GATECHA & CO LLP.

Important note: This does not lead to legal advice or legal opinion and is personal view and for information purpose only. It is prepared on the basis of facts available and applicable law.It is suggested to go through applicable provisions of law,latest regulations,judicial announcements, circulars, notifications and clarifications etc before taking any action based on above content.You agree here by that for any action taken on basis of above information in any manner writer or K M GATECHA & CO LLP is not responsible or liable for any omission,reliability,accuracy,completeness,errors or authenticity.This work by professional is just for knowledge purpose and does not constitute any kind of solicitation of work or advertisement.

-

Section 10 Of Income Tax Act_ Exemptions, Allowances & How To Claim It15/08/2024/0 Comments

Section 10 Of Income Tax Act_ Exemptions, Allowances & How To Claim It15/08/2024/0 Comments -

Steps to register private limited company15/08/2024/

Steps to register private limited company15/08/2024/ -

Cancellation of registration under GST26/05/2024/

Cancellation of registration under GST26/05/2024/ -

-

Introduction to Transfer Pricing in India13/04/2024/

Introduction to Transfer Pricing in India13/04/2024/ -

-

-

Tax Liability of a NRI24/12/2023/

Tax Liability of a NRI24/12/2023/ -

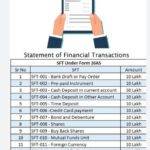

Everything about SFT18/12/2023/

Everything about SFT18/12/2023/ -

Documents to be maintained by NGo or trust17/12/2023/

Documents to be maintained by NGo or trust17/12/2023/ -

-

-

-

-

Taxation of Charitable/Religious Trust04/09/2023/

Taxation of Charitable/Religious Trust04/09/2023/ -

-

Application for Filing Clarification – GST09/06/2023/

Application for Filing Clarification – GST09/06/2023/ -

How to check GST application status09/06/2023/

How to check GST application status09/06/2023/ -

-

Gift tax under section 56(2)x03/06/2023/

Gift tax under section 56(2)x03/06/2023/ -

-

-

-

-

-

-

All about Appeal under GST20/05/2023/

All about Appeal under GST20/05/2023/ -

All about GSTR 10, GST Amnesty16/05/2023/

All about GSTR 10, GST Amnesty16/05/2023/ -

-

-

TDS on purchase of goods u/s 194Q17/01/2022/

TDS on purchase of goods u/s 194Q17/01/2022/ -

Situations of GST refund and process10/01/2022/

Situations of GST refund and process10/01/2022/ -

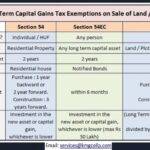

Tax on property sale in India05/01/2022/

Tax on property sale in India05/01/2022/ -

House Rent Deduction in Income Tax01/01/2022/

House Rent Deduction in Income Tax01/01/2022/ -

-

-

Table of Contents

Toggle