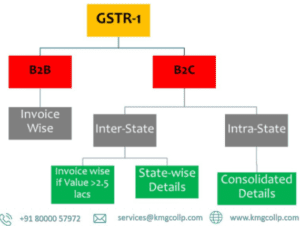

We have seen a number of changes in the GST Regime, including changes made to returns. The government introduced GSTR-3B, which is a summary return, for a brief time, along with FORM GSTR-1 and FORM GSTR-2 for further information. It was explained that the framework will naturally accommodate the information submitted in Structure GSTR-3B with Structure GSTR-1 and Structure GSTR-2, and the varieties assuming any will either be counterbalanced against yield charge risk or added to the result charge responsibility of the ensuing a long time of the enrolled individual.

According to section 37(3) of the CGST Act, any registered person who has provided the information required by section 37(1) for a particular tax period but has not been matched by section 42 or section 43 of the CGST Act must, upon discovery of any error or omission therein, rectify the error or omission in the manner that may be prescribed, pay tax and interest, if any, in return for the information provided for that tax period.

With the exception of the first proviso to section 37(3) of the CGST Act, which states that no corrections for errors or omissions in the information submitted in accordance with section 37(1) of the CGST Act will be accepted after the submission of the return required by section 39 for the month of September following the end of the financial year to which the information relates or the submission of the relevant annual return, whichever comes first.

Department has issued a detailed circular No. 26/26/2017=GST dated 29-12-2017 giving instructions to correct errors made in filing GSTR-3B.

It is clarified that since the return on FORM GSTR-3B does not include a section for reporting differential figures for previous months, those figures can be reported in the appropriate tables, such as Table No. 3.1, 3.2, 4, and 5, depending on the situation.

It should be noted that the FORM GSTR-3B cannot contain any negative entries while an adjustment is being made to the output tax liability or the input tax credit. The remaining amount for adjustment, if any, can be adjusted in the return(s) for the subsequent month(s) using the FORM GSTR-3B, and a refund can be claimed if this is not possible.

When multiple months’ worth of changes have been made in FORM GSTR-3B, the corresponding changes in FORM GSTR-1 should ideally also be made in the corresponding months.

Mistakes in GSTR-3B:

Filing of GSTR-3B return is a four step process – Stage 1 – Confirmed Submission, Stage 2 – Cash Ledger Updated. Stage 3 – Offset Liability, Stage 4 – Return filed. Before discussing about the errors, we must know the stage at which we want to correct or modify the data in GSTR 3B

Stages | Process | Editing Option | Remarks for stage |

Stage 1 | Submit | Available | At this stage tax liabilities and inputs are confirmed and submitted |

Stage 2 | Cash Ledger | Available | Cash is added to the electronic cash ledger as per return liability |

Stage 3 | Offset Liability | Not Available | All tax liabilities are adjusted with credit ledger and cash ledger. |

Stage 4 | Filing of Return | Not Available | Return is filed finally. |

The return can be edited at Stage 1 and Stage 2 only. The return cannot be edited at stage 3 and stage 4.

All things considered, the change can be made exclusively consequently of the following month, as there is no arrangement to correct the GSTR-3B return subsequent to recording.

Now, if the errors were discovered prior to offsetting and filing, they can be fixed by editing the appropriate liability side, input side, or other side. However, if the errors are discovered after the offset and return filing, we must take the following steps, as the circular suggests:

Common Errors Types in GST Returns:

- Under-reporting of Tax Liability (Return filed)

After paying the interest, liability can be added to the return in the next month or months. Let’s say that a sale bill was not reported in one month; as a result, the liability will increase when the sales amount from that month is added to the sales from the current month. In addition to paying the appropriate interest amount, the aforementioned liability must be paid. Under GSTR 3B extra marketing projection will be included point no. 3.1 for example “Outward supplies and internal supplies on switch charge”. However, only payment can be made in GSTR 3B, where the aforementioned interest can be shown.)

On the off chance that such responsibility was not detailed in Structure GSTR-1 of the month/quarter concerned, then, at that point, such obligation might be pronounced in the resulting month’s/quarter’s Structure GSTR-1 wherein installment was made. ( It is possible to reconcile the GSTR 1 data with the tax liability and interest that are considered in GSTR 3B.

- Over-reporting of Liabilities

In the event that an adjustment is not possible, liability can be reduced or a refund requested. If a bill was booked twice or sales return transactions were missed, they can be adjusted with the current month’s liability, if at all possible; otherwise, a refund can be requested. Under GSTR 3B, the total sales figure will be subtracted (if possible) from the reported sales figure. 3.1, more specifically, “Outward supplies and inward supplies on reverse charge.” It should be noted that negative entries on the FORM GSTR-3B are not allowed when making adjustments to the output tax liability or the input tax credit.

If the liability was reported in excess in the month or quarter’s FORM GSTR-1 as well, it can be amended in accordance with Table 9 of the FORM GSTR-1.

- Wrong-reporting of Liabilities

If any interest is owed, unreported liabilities may be included in the return for the following month. Additionally, change might be made in kind of ensuing month(s) or discount might be asserted where change isn’t achievable. ( Suppose liability was shown with a low tax rate or if liability was shown as intrastate liability. Then said highway obligation or the equilibrium charge responsibility must be paid and before paid intrastate expense can be changed later or can for guaranteed as discount.).

These taxpayers will need to fill out Table 9 of the FORM GSTR-1 for the following month or quarter to request amendments.

- Under-reporting of ITC

Input tax break which was not announced might be profited while recording return for ensuing month(s). ( If certain purchases weren’t taken into account, we can still take them into account in the next month’s purchases and take advantage of the input tax credit that is available. Under GSTR 3B in point no. 4: “Eligible ITC”: More ITC can be added. No, there is no need to take any action in GSTR 2 or 3, as both are currently ineffective.)

No activity expected in GSTR-1.

- Over-reporting of ITC

Reverse this over reported input tax credit with interest in the return of subsequent months or pay in cash. Assume in the event that we have guaranteed more info tax reduction and furthermore used, we want to change or pay something similar alongside the relevant interest sum.)

No activity expected in GSTR-1.

- Wrong-reporting of ITC

Pay any incorrectly reported input tax credit in cash or reverse it in the month(s) following.

If the input tax credit was not reported, it can be used in the next month or months.

No activity expected in GSTR-1.

- Cash Ledger wrongly reported ( Only Stage 2 effected)

Add money to the correct tax head and ask for a cash refund for the money that was added to the wrong tax head. If we have deposited IGST into the wrong head (CGST head and SGST head), we must deposit CGST and SGST, and we can either claim a refund or adjust the surplus IGST for future liabilities.)

No activity expected in GSTR-1

FAQs

Can I make amendments to a gstr-1 of a particular tax period?

Yes, you can make amendments to an already filed GSTR-1 of a particular tax period by declaring the amended details in the return. For example, Mr X of Kerala has sold goods to Mr Y of Karnataka for Rs. 1,00,000 on 30th December 2022 and declared in the GSTR-1 of December 2022.

Can a return be revised under GST?

A return once filed cannot be revised under GST. Any mistake made in the return can be rectified in the GSTR-1 filed for the next period (month/quarter). It means that if a mistake is made in GSTR-1 of December 2022, rectification for the same can be made in the GSTR-1 of January 2023 or subsequent months.

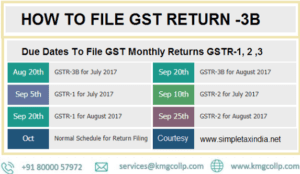

When to file gstr-3b

The last date to make amendments, corrections in GSTR-3B, and claim any missed Input Tax Credit or ITC of one financial year is no longer due date to file September return of the following year, but it is 30th November of the following year or filing of annual return, whichever is earlier.

Disclaimer: The materials provided herein are for informational purposes only and do not constitute legal, financial, or professional advice. Consult relevant laws and experts before acting on this information. Neither the author nor K M GATECHA & CO LLP is liable for any inaccuracies or omissions. This material is purely educational and not an advertisement or solicitation.

Table of Contents

Toggle