In India, an individual’s tax responsibility depends on their residential status, categorized into three types according to the Income Tax Act 1961:

- Resident (ROR)

- Resident but Not Ordinarily Resident (RNOR)

- Non-Resident (NR)

Non-Resident Indian (NRI).

The Act doesn’t explicitly define an NRI, but it outlines specific criteria to determine who qualifies as a resident of India. Consequently, anyone not meeting these criteria is classified as an NRI.

Under Section 6(1) of the Income Tax Act, an individual is considered a resident in India if they meet any of the following conditions:

- If he/she remains in India for 182 days or more during a financial year, or if they are in India for 60 days.

- or more in a financial year, and being in India for 365 days or more over the 4 years immediately preceding the previous year.

However, for Indian citizens employed abroad or crew members on an Indian ship, only the first condition applies. Therefore, an individual becomes a resident once they spend at least 182 days in India. This amendment was introduced in the Finance Act of 2020.

Finance Act Amendent 2020

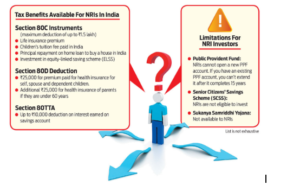

The Finance Act 2020 revised the rules regarding residency for income tax purposes to now encompass Indian Citizens/Persons of Indian Origin visiting India, who will be regarded as RNOR (Resident but Not Ordinarily Resident) based on specific conditions.

- The total income, excluding income from foreign sources, amounts to Rs 15 lakh or above.

- The person has been in India for over 120 days but less than 182 days in the preceding year.

- The person has been in India for 365 days or longer in the four years before the previous year.

Prior to this amendment, individuals fitting these criteria were categorized as non-residents. However, following this change, the individual’s residency status might now be designated as RNOR, resulting in the forfeiture of DTAA benefits, a broader scope of total income subject to taxation, and the loss of various permissible exemptions, among other consequences.

Tax liability for NR

The tax burden of NRIs in India is limited to the income they make in the country. They are not required to pay any tax in India on their international earnings. They are only taxed on the income earned in India

In case when the same income is taxed both overseas and India, the NRI may look for relief under the Double Taxation Avoidance Agreement (DTAA) if India has signed with the other nation to avoid paying taxes twice.

FAQ’s

- What is the 120 days rule for NRI?

The duration is extended to 120 days for an individual, whether an Indian citizen or a person of Indian origin (PIO), residing outside India, visiting India, provided that the total income of such an individual, excluding income from foreign sources, exceeds ₹15 lakh (the 120-day rule).

- How can NRI avoid TDS?

In order to reduce the TDS (Tax Deducted at Source) on the sale of a property by an NRI, they are required to submit an application in Form 13 to the income tax department to obtain a certificate for Nil/Lower Deduction of TDS. This certificate helps NRIs lessen their TDS liability, and hence, it’s a choice preferred by most NRIs.

- Do NRI need to pay tax in India?

Non-Resident Indians (NRIs) must file an income tax return if they possess taxable income in India. Specifically, an NRI is obligated to file an Income Tax Return in India if their Gross Total Income, before considering any deductions under section 80, exceeds Rs. 2,50,000.

- Why is TDS so high for NRI?

If an NRI doesn’t possess a PAN (Permanent Account Number), as per section 206AA of the Income Tax Act, the payer is mandated to deduct tax* at an elevated rate. The higher of the TDS rates specified in the provisions of the Income Tax Act, 1961, will be applied.

- Is it mandatory for NRI to file ITR?

Under income tax regulations, starting from the financial year 2017-18, Non-Resident Indians (NRIs) must file returns using ITR 2 for all scenarios except when they have business income. NRIs earning business income are required to file an income tax return using ITR 3.

Disclaimer: The materials provided herein are for informational purposes only and do not constitute legal, financial, or professional advice. Consult relevant laws and experts before acting on this information. Neither the author nor K M GATECHA & CO LLP is liable for any inaccuracies or omissions. This material is purely educational and not an advertisement or solicitation.