GST Refund: A Comprehensive Step-by-Step Guide

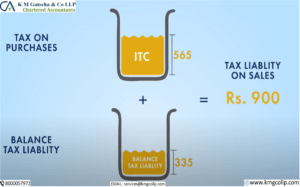

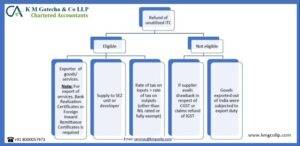

The process of claiming a GST refund involves following a defined procedure, submitting necessary documents, and providing declarations where required. Taxpayers must apply to the GST authorities to request a…