Application for Filing Clarification GST

1.I have been notified that the registration application I submitted to the GST Portal requires clarifications. Why?

My application is in “Pending for Clarification” status. What is it implying?

The taxpayer can request clarification from the tax official if the official is dissatisfied with the information provided in the registration application or the documents attached.

The application’s status is changed to “Pending for Clarification” in these situations.

Within seven working days of receiving the notice seeking clarifications, you must login to the GST Portal using your TRN and provide the requested clarifications electronically or upload the requested document(s).

Application for Filing Clarification

I have been notified that the registration application I submitted to the GST Portal requires clarifications. How should I respond to the tax official’s notice?

To respond to the notice seeking clarifications on the GST Portal, perform the following steps:

- Access the https://www.gst.gov.in/ URL. The GST Home page is displayed.

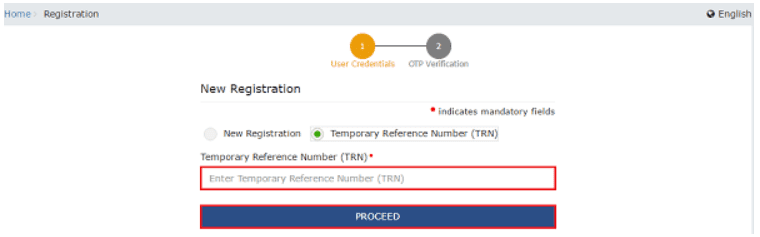

In case of New Registration:

- Click the REGISTER NOW link.

- Select the Temporary Reference Number (TRN) option.

- In the Temporary Reference Number (TRN) field, enter the TRN received.

- Click the PROCEED button.

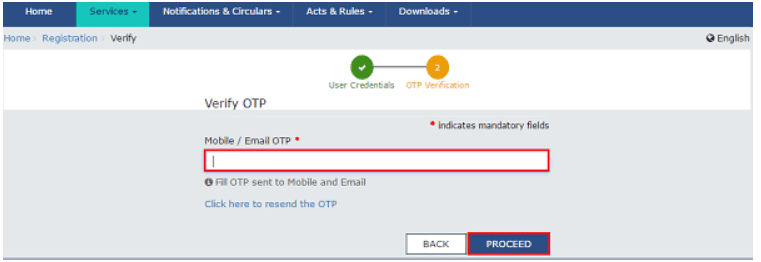

5. In the Mobile / Email OTP field, enter the OTP you received on your mobile number and email address. OTP is valid only for 10 minutes.

5. In the Mobile / Email OTP field, enter the OTP you received on your mobile number and email address. OTP is valid only for 10 minutes.

Note:

OTP sent to mobile number and email address are same.

In case OTP is invalid, try again by clicking the Click here to resend the OTP link. You will receive the OTP on your registered mobile number or email ID again. Enter the newly received OTP again.

6. Click the PROCEED button.

In case of Existing Registration:

- Login to the GST Portal with valid credentials.

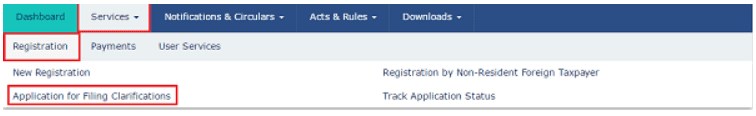

- Click Services > Registration> Application for Filing Clarifications command.

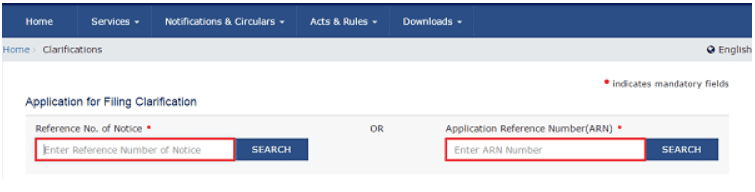

3. In the Reference No. of Notice field, enter the reference number specified on the notice which you have received for filing the clarifications. Or In the Application Reference Number (ARN) field, enter the application reference number received corresponding to the application submitted. Click the SEARCH button.

- In the Modification in the Registration Application filed field, select Yes or No.

In case of Yes:

- All fields for which Notice has been issued can be edited in the original application. Edit the specifics and upload any necessary additional documents.

In case of No:

- In the Additional Information field, enter the additional information.

Note:

You really want to enter reaction to every one of the questions in the textbox gave relating to each inquiry.

You can save the form at any time within a maximum of seven working days of receiving the notice to ask the tax official for clarifications.

- Submit the application using SUBMIT WITH DSC or SUBMIT WITH E-SIGN as applicable/ eligible.

In case of SUBMIT WITH DSC:

- Click the SUBMIT WITH DSC button.

- Click the PROCEED button.

- Select the certificate and click the SIGN button.

- Enter the PIN (dongle password) for the attached DSC.

In case of SUBMIT WITH E-SIGN:

- Click the SUBMIT WITH E-SIGN button.

- In the Declaration box, click the AGREE button.

Note: OTP will be sent to your e-mail address and mobile phone number registered with Aadhaar.

- In the Declaration box, click the AGREE button.

- Verify Aadhaar OTP screen is displayed. Enter the OTP received on your e-mail address and mobile phone number registered with Aadhaar. Click the CONTINUE button.

- Success message is displayed.

Note: Intimation of submission of the form by the Taxpayer is sent via SMS to the applicant on the registered mobile number. Email is sent to the applicant as well the authorized signatory.

Owner of this information can be reached at K M GATECHA & CO LLP.

Important note: This does not lead to legal advice or legal opinion and is personal view and for information purpose only. It is prepared on the basis of facts available and applicable law.It is suggested to go through applicable provisions of law,latest regulations,judicial announcements, circulars, notifications and clarifications etc before taking any action based on above content.You agree here by that for any action taken on basis of above information in any manner writer or K M GATECHA & CO LLP is not responsible or liable for any omission,reliability,accuracy,completeness,errors or authenticity.This work by professional is just for knowledge purpose and does not constitute any kind of solicitation of work or advertisement.

-

Section 10 Of Income Tax Act_ Exemptions, Allowances & How To Claim It15/08/2024/0 Comments

Section 10 Of Income Tax Act_ Exemptions, Allowances & How To Claim It15/08/2024/0 Comments -

Steps to register private limited company15/08/2024/

Steps to register private limited company15/08/2024/ -

Cancellation of registration under GST26/05/2024/

Cancellation of registration under GST26/05/2024/ -

-

Introduction to Transfer Pricing in India13/04/2024/

Introduction to Transfer Pricing in India13/04/2024/ -

-

-

Tax Liability of a NRI24/12/2023/

Tax Liability of a NRI24/12/2023/ -

Everything about SFT18/12/2023/

Everything about SFT18/12/2023/ -

Documents to be maintained by NGo or trust17/12/2023/

Documents to be maintained by NGo or trust17/12/2023/ -

-

-

-

-

Taxation of Charitable/Religious Trust04/09/2023/

Taxation of Charitable/Religious Trust04/09/2023/ -

-

How to check GST application status09/06/2023/

How to check GST application status09/06/2023/ -

-

Gift tax under section 56(2)x03/06/2023/

Gift tax under section 56(2)x03/06/2023/ -

-

-

-

-

-

-

All about Appeal under GST20/05/2023/

All about Appeal under GST20/05/2023/ -

Old vs New income tax regime18/05/2023/

Old vs New income tax regime18/05/2023/ -

All about GSTR 10, GST Amnesty16/05/2023/

All about GSTR 10, GST Amnesty16/05/2023/ -

-

-

TDS on purchase of goods u/s 194Q17/01/2022/

TDS on purchase of goods u/s 194Q17/01/2022/ -

Situations of GST refund and process10/01/2022/

Situations of GST refund and process10/01/2022/ -

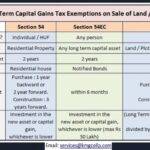

Tax on property sale in India05/01/2022/

Tax on property sale in India05/01/2022/ -

House Rent Deduction in Income Tax01/01/2022/

House Rent Deduction in Income Tax01/01/2022/ -

-

-