Situations of GST refund and process

GST refund is a procedure in which a taxpayer wants to get the amount, which is in excess of the GST liability, refunded to his/her account.

The taxpayer can claim refund by submitting an application form for a refund on the GST portal. Proper details must be provided along with the correct form and procedure to ensure timely refund of excess GST amount, as the delay can lead to capital crunch for the business.

Situations of GST refund and process-Situations

The various situations that can result in needing to apply for refund claim are as follows (please not we do try to cover all reasons but there might be other reasons as well): –

- Refund of taxes when embassies make purchases,

- Excess payment due to error by taxpayer,

- Finalization of provisional assessment,

- Sales which are later deemed as exports,

- Refund of pre-deposit,

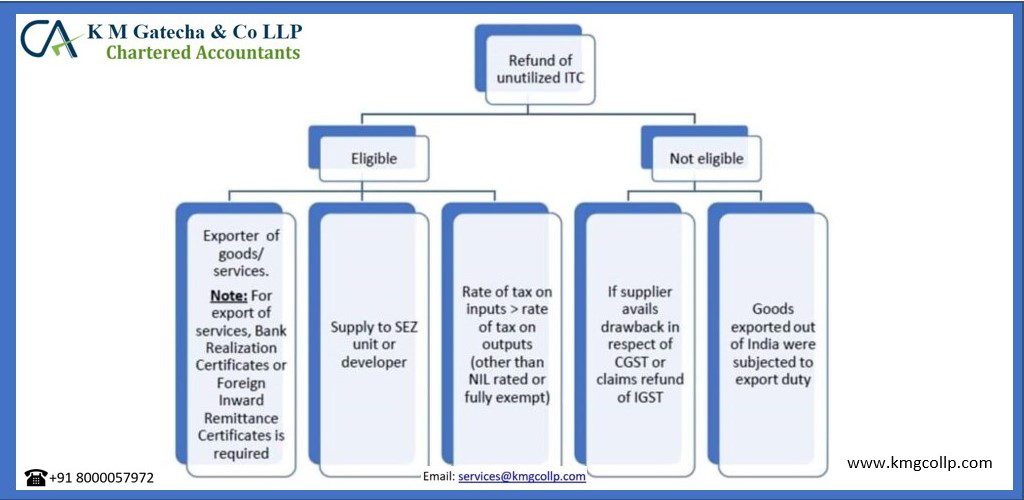

- Accrued input tax credit due to inverted tax structure,

- Refund due to any judgement, direction or decree of The Appellate Tribunal, or any court of law,

- Supply to any developer and units in Special Economic Zones (SEZs)

- Export of commodities or services,

- Refund of IGST to international tourist.

Situations of GST refund and process.-Process

- Refund can only be applied for at end of each quarter,

- Filling form on GSTIN portal,

- Receipt of acknowledgement number on SMS and Email,

- The cash and return ledger will be adjusted in claimed amount,

- The application and document submitted will be scrutinized by authorities within 30-days of application (provided it is not deemed as “Unjust Enrichment” which indicates that one is unjustly profiting at expense of the other),

- If the refund is deemed as unjust enrichment, then the refund is transferred to Consumer Welfare Fund.

- In case the refund claimed is more than predetermine amount then pre-audit will be conducted before refund is sanctioned.

- Refund is processed through NEFT, RTGS or ECS.

- If refund is below INR 1000 then no refund will be issued.

Situations of GST refund and process-Documents required

- Basic Documents: –

- Statement of relevant invoices showing the base for claim of refund.

- For Export of services: –

- Relevant bank realization certificates.

- For sale to operators in Special Economic Zones (SEZs): –

- Endorsement by authorized officer, verifying the receipt of commodities,

- Declaration by SEZ unit, stating that Input Tax Credit of the tax paid by supplier has not been availed.

situations of GST refund and process-Checking status

For all other refunds:

- Visit GSTIN portal (https://www.gst.gov.in/)

- Login to your account or directly proceed to next step,

- Go to Services > Refunds > Track application status,

- Find relevant year in which the refund application is filed (skip for without logging in),

- Enter the ARN (acknowledgement receipt number) of the refund application,

- Look for payment advice status.

- If the application is processed and message say “Bank validation failed” then you have to “update bank details” then you will have to:

- Update bank details,

- File the bank details with DSC,

- Authenticate it with OTP on mobile and email-id to confirm the update.

- For refunds on IGST paid on export of goods:

- First 2 steps from above,

- Go to Services> Refunds > Track status of invoice data shared with ICEGATE,

- Search for relevant financial year and month for which refund has been applied for,

- Look for “Invoices rejected by ICEGATE” and click on the number in “count column” to view,

- Download the failed invoices for validation, take corrective action, and re-submit.

How is GST Refund calculated?

- GST is calculated as “Outward tax liability- input tax credit”

- If input tax credit is greater than outward liability then “TDS/TCS, interest and penalties” are deducted from the amount to arrive at the refund amount

Time limit

- The time limit on applying for refund is 2 years

- from date of payment,

- for export: Date of dispatch/loading/passing the frontier,

- ITC accumulated as output is exempt or nil rated then “Last date of relevant financial year”,

- Finalization of provisional assessment: Date on which tax is adjusted.

Owner of this information can be

reached at K M GATECHA & CO LLP – CA in Ahmedabad.

Important note: This does not lead to legal advice or

legal opinion and is personal view and for information purpose only. It is prepared on the basis of facts available and applicable law.It is suggested to go through applicable provisions of law,latest regulations,judicial announcements, circulars, notifications and clarifications etc before taking any action based on above content.You agree here by that for any action taken on basis of above information in any manner writer or K M GATECHA & CO LLP is not responsible or liable for any omission,reliability,accuracy,completeness,errors or authenticity.This work by professional is just for knowledge purpose and does not constitute any kind of solicitation of work

or advertisement.

The concept of unjust enrichment implies that one person should not unjustly benefit at the expense of the other.

A taxpayer can apply for refund within 2 years of date of payment of the said GST.

Refund must be sanctioned within 60 days of application, otherwise interest must be paid in as per section 56 of GST act.

No, if the ITC is at 18% and output tax is 5% the input tax accumulated cannot be claimed as GST refund.

Table of Contents

Toggle