We will first examine the few fundamental responsibilities of a person liable to deduct or collect tax at source for TCS/TDS return filing return before understanding the TDS return late filing penalty is upto Rs.100000.

Obligations of the individual at risk to deduct/gather charge at source

He is responsible for collecting the tax at the appropriate rate at the source.

He will pay the expense deducted/gathered by him to the credit of the Public authority.

He will record the intermittent TDS/TCS proclamations, i.e., TDS/TCS return.

In relation to the tax that he has taken out or collected, he must issue the TDS/TCS certificate.

Basic provisions

You can learn about the provisions of sections 234E and 271H in this section. A person who fails to file the TDS/TCS return or does not file the TDS/TCS return by the due dates specified in this regard must pay the late filing fees outlined in section 234E. In addition to the late filing fees, the person must pay the penalty outlined in section 271H.

Late filing fees under section 234E

In accordance with Section 234E, if a person fails to submit the TDS/TCS return by the specified deadline, he will be required to pay a fee of Rs. 200 for each day during which the disappointment proceeds. The amount of TDS return late fees can’t be more than the TDS.

The TDS/TCS return cannot be submitted without the payment of the above-mentioned filing TDS return late fees . At the end of the day, the late documenting charges will be stored prior to recording the TDS return. It is important to note that Rs. 200 per day is a late filing fee, not a penalty.

Illustration

Let’s assume a scenario where a company fails to file its TDS return within the due date. The TDS deducted by the company amounts to Rs. 1,00,000.

Late Filing Fee: The late filing fee is Rs. 200 per day for each day of delay until the return is filed, subject to a maximum amount equal to the TDS deducted. Let’s say the company files the TDS return 15 days late. The late filing fee would be calculated as follows:

15 days × Rs. 200 = Rs. 3,000

Penalty for Late Filing: If the TDS return is not filed within one year from the due date, a penalty of Rs. 200 per day can be levied under Section 234E. Let’s say the company files the TDS return 120 days late. The penalty would be calculated as follows:

120 days × Rs. 200 = Rs. 24,000

Disallowance of Deduction: Failure to file the TDS return within the prescribed time limit may result in the disallowance of the deduction claimed against the TDS amount. In this case, if the company had claimed a deduction of Rs. 1,00,000 against the TDS, it could be disallowed, leading to additional tax liability based on the applicable tax rate.

Again, please note that these numbers are for illustrative purposes, and the actual fees and penalties may vary based on the specific circumstances and the provisions of the Income Tax Act. It’s always recommended to consult with a tax professional for accurate and up-to-date information.

Penalty under section 271H

According to segment 271H, where an individual neglects to document the assertion of duty deducted/gather at source for example TDS/TCS return prior to the due dates recommended in such manner, then, at that point, evaluating official might direct such individual to suffer consequence under segment 271H. Least punishment can be imposed of Rs. 10,000, which may reach Rs. 1,00,000. Punishment under area 271H will be as well as late documenting charges recommended under segment 234E.

Section 271H also covers cases in which an incorrect TDS/TCS return is filed, in addition to cases in which a TDS/TCS return is filed late. If the deductor or collector submits an incorrect TDS/TCS return, a penalty under Section 271H may also be imposed. To put it another way, a fine of Rs. 10,000 and most extreme punishment.

If a person can demonstrate that they had filed their TDS/TCS return within a year of the due date, they will not be subject to a penalty under Section 271H for failing to do so. This applies even if the person paid the late filing fee and any interest (if any) to the credit of the Central Government. In other words, if the following conditions are met, a delay in filing the TDS/TCS return will not result in a penalty under section 271H:

The duty deducted/gathered at source is paid to the credit of the Public authority.

Late documenting charges and interest (if any) is paid to the credit of the Public authority.

The TDS/TCD return must be submitted before the one-year deadline specified in this regard.

It should be noted that filing an incorrect TDS/TCS statement does not qualify for the above-mentioned relaxation; rather, it only applies to penalties imposed under section 271H for tardiness in filing the TDS/TCS return.

Under area 273A(4) the Foremost Magistrate of Personal expense or Chief of Annual assessment has ability to defer or decrease the punishment collected under the Annual duty Act. If the requirements outlined in section 273A(4) are met, the Commissioner of Income Tax may reduce or waive the penalty.

In real cases, section 273B provides immunity from penalty in addition to shelter under section 273A(4). According to segment 273B, punishment under segment 271H won’t be imposed assuming the citizen demonstrates that there was a sensible reason for disappointment.

Faqs on TDS return late filing penalty

As of our knowledge cut off in September 2021, the late filing fee for TDS returns is Rs. 200 per day until the return is filed. This fee is applicable for each day of delay beyond the due date. However, it’s important to check for any updated fee structure, as it may change over time.

Yes, there can be a penalty under Section 234E of the Income Tax Act. The penalty is Rs. 200 per day until the return is filed, subject to a maximum amount equal to the total amount of tax deducted. The penalty is separate from the late filing fee and is meant to discourage delayed filing of TDS returns.

Generally, the late filing fee and penalty for TDS returns are not waived off unless there are genuine reasons for the delay. Valid reasons may include technical issues with the e-filing portal or exceptional circumstances. In such cases, the deductor may need to provide supporting documents, valid reasons, and request for waiver or appeal to the Income Tax Department.

Owner of this information can be reached at K M GATECHA & CO LLP.

Important note: This does not lead to legal advice or legal opinion and is personal view and for information purpose only. It is prepared on the basis of facts available and applicable law.It is suggested to go through applicable provisions of law,latest regulations,judicial announcements, circulars, notifications and clarifications etc before taking any action based on above content.You agree here by that for any action taken on basis of above information in any manner writer or K M GATECHA & CO LLP is not responsible or liable for any omission,reliability,accuracy,completeness,errors or authenticity.This work by professional is just for knowledge purpose and does not constitute any kind of solicitation of work or advertisement.

-

Section 10 Of Income Tax Act_ Exemptions, Allowances & How To Claim It15/08/2024/0 Comments

Section 10 Of Income Tax Act_ Exemptions, Allowances & How To Claim It15/08/2024/0 Comments -

Steps to register private limited company15/08/2024/

Steps to register private limited company15/08/2024/ -

Cancellation of registration under GST26/05/2024/

Cancellation of registration under GST26/05/2024/ -

-

Introduction to Transfer Pricing in India13/04/2024/

Introduction to Transfer Pricing in India13/04/2024/ -

-

-

Tax Liability of a NRI24/12/2023/

Tax Liability of a NRI24/12/2023/ -

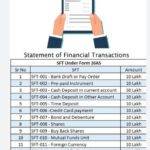

Everything about SFT18/12/2023/

Everything about SFT18/12/2023/ -

Documents to be maintained by NGo or trust17/12/2023/

Documents to be maintained by NGo or trust17/12/2023/ -

-

-

-

-

Taxation of Charitable/Religious Trust04/09/2023/

Taxation of Charitable/Religious Trust04/09/2023/ -

-

Application for Filing Clarification – GST09/06/2023/

Application for Filing Clarification – GST09/06/2023/ -

How to check GST application status09/06/2023/

How to check GST application status09/06/2023/ -

-

Gift tax under section 56(2)x03/06/2023/

Gift tax under section 56(2)x03/06/2023/ -

-

-

-

-

-

All about Appeal under GST20/05/2023/

All about Appeal under GST20/05/2023/ -

Old vs New income tax regime18/05/2023/

Old vs New income tax regime18/05/2023/ -

All about GSTR 10, GST Amnesty16/05/2023/

All about GSTR 10, GST Amnesty16/05/2023/ -

-

-

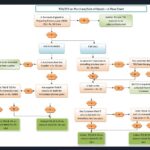

TDS on purchase of goods u/s 194Q17/01/2022/

TDS on purchase of goods u/s 194Q17/01/2022/ -

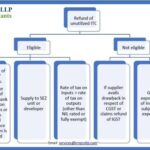

Situations of GST refund and process10/01/2022/

Situations of GST refund and process10/01/2022/ -

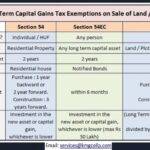

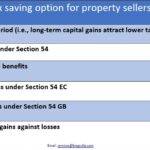

Tax on property sale in India05/01/2022/

Tax on property sale in India05/01/2022/ -

House Rent Deduction in Income Tax01/01/2022/

House Rent Deduction in Income Tax01/01/2022/ -

-

-

Table of Contents

Toggle