GST will significantly boost the government’s ‘Make in India’ initiative by making goods and services produced or provided in India competitive in national and international markets. Furthermore, all imported goods will be subject to integrated taxation (IGST), which will be roughly equivalent to Central GST + State GST. This achieves tax parity between domestic and imported goods.

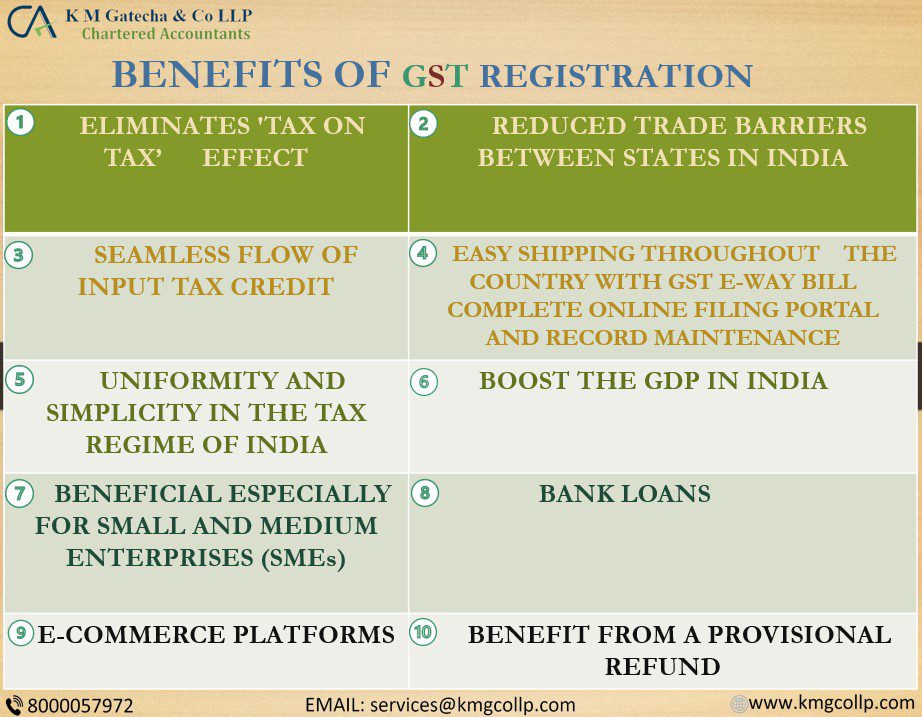

BENEFITS OF GST REGISTRATION

It benefits all stakeholders, including industry, government, and citizens. It is expected to reduce the cost of goods and services, boost the economy, and make our products and services more competitive on a global scale. GST aims to make India a common national market with uniform tax rates and procedures, as well as to remove economic barriers, paving the way for a national integrated economy. GST will reduce the negative effects of cascading by combining most of the Central and State indirect taxes into a single tax and allowing the set-off of prior-stage taxes for transactions throughout the whole value chain.

- ELIMINATES ‘TAX ON TAX’ EFFECT

- REDUCED TRADE BARRIERS BETWEEN STATES IN INDIA

- SEAMLESS FLOW OF INPUT TAX CREDIT

- EASY SHIPPING THROUGHOUT THE COUNTRY WITH GST E-WAY BILL COMPLETE ONLINE FILING PORTAL AND RECORD MAINTENANCE

- UNIFORMITY AND SIMPLICITY IN THE TAX REGIME OF INDIA

- BOOST THE GDP IN INDIA

- BENEFICIAL ESPECIALLY FOR SMALL AND MEDIUM ENTERPRISES (SMES)

- BANK LOANS

- ECOMMERCE PLATFORMS

- BENEFIT FROM A PROVISIONAL REFUND

Boost the GDP in India:

GST is expected to increase government income by widening the tax base and increasing taxpayer compliance. GST is expected to boost India’s economy. It has a high position in the Ease of Doing Business Index. GDP is expected to rise by 1.5 percent to 2 percent. By establishing a level playing field, the GST will prevent tax cascading.

Beneficial especially for Small and Medium Enterprises (SMEs):

Small business owners are interested in analysing the potential effects of GST on their businesses, thanks to the adoption of GST. SMEs (Small and Medium Enterprises) are well-known as the economy’s principal growth engine and major contributors to GDP.

Bank Loans:

GST registration and return filing serve as proof of business activity and help a company establish a track record. Banks and non-bank financial institutions (NBFCs) lend to businesses based on information from GST returns. As a result, GST registration might assist you in formalizing your firm and obtaining credit.

E-Commerce:

GST registration is required to sell online and through platforms such as Amazon, Flipkart, Snapdeal, Zomato, Swiggy, and others. Having a GST registration allows you to sell online.

Provide input tax credit to customers:

All taxes paid on export goods or services, as well as inputs and input services used in the delivery of such goods or services, shall be repaid. Across the board input tax credit system, the complete supply chain Such a constant accessibility Input Tax Credits are available for a variety of goods and services at every level. You can issue taxable invoices now that your company is officially recognised. Buyers can then use input credit toward their purchases. This will help to expand the client base and increase the company’s competitiveness.

Benefit from a provisional refund

The principle of only exporting the cost of goods or services, rather than taxes, would be followed. This will boost Indian exports, improving the country’s balance of payments position. Exporters will benefit from a provisional refund of 90% of their claims within seven days of receiving acknowledgment of their application, resulting in an improvement in cash flow position.

We are a trusted CA Firm in Ahmedabad. At K M GATECHA & CO LLP, we provide the best GST registration related services in Gujarat and can help you minimize your tax exposure and highlight the risks presented by constantly evolving and increasingly complex legislation. At K M GATECHA & CO LLP, we provide you a complete overview of your business and helps you with the necessary steps that need to be taken for a positive outlook on your business.

Frequently Asked Questions:

GST is an easy-to-understand tax that also helps to reduce the number of indirect taxes. There will be no hidden taxes and the cost of conducting business would be cheaper because GST will not be a burden to registered shops. People will benefit because prices will drop, which will boost businesses since consumption will rise.

Prior to the adoption of GST, any business with a revenue of more than Rs 5 lakh in a financial year had to register for VAT. Any business with a turnover of more than Rs 40 lakh in a financial year, on the other hand, must register for GST.

GST makes it much easier for your business to calculate taxes and stay on top of tax payments by combining all indirect taxes under one umbrella. Furthermore, you may discover that the cost of running logistics and operations has decreased dramatically.

Disclaimer: The main goal of this article is to “assist investors in making informed financial decisions.” The above information is provided only for educational purposes. Readers are advised to exercise caution and seek professional counsel before relying on the above information. K M Gatecha & CO LLP is not liable for any loss or harm incurred by readers who take action based on the information provided in this article. “Please keep in mind that the opinions expressed in this Blog/Comments Section/Forum are clarifications intended for the readers’ reference and guidance as they investigate further on the topics/questions raised and make informed decisions. These are not intended to be investment advice or legal advice.”

Table of Contents

Toggle