The taxability of gifts is a popular and frequently asked subject among taxpayers. In this article, you’ll learn about the numerous rules relating to the ‘TAX ON SALE OF PROPERTY RECEIVED AS GIFT’ received by a person or a Hindu Undivided Family (HUF), such as a sum of money or property obtained without consideration or a circumstance in which the property is bought for insufficient consideration.When you sell a property that you received as a gift in India, specific tax implications arise, primarily concerning capital gains tax. Understanding these implications is crucial to ensure compliance with the Income Tax Act and to optimize your tax liabilities

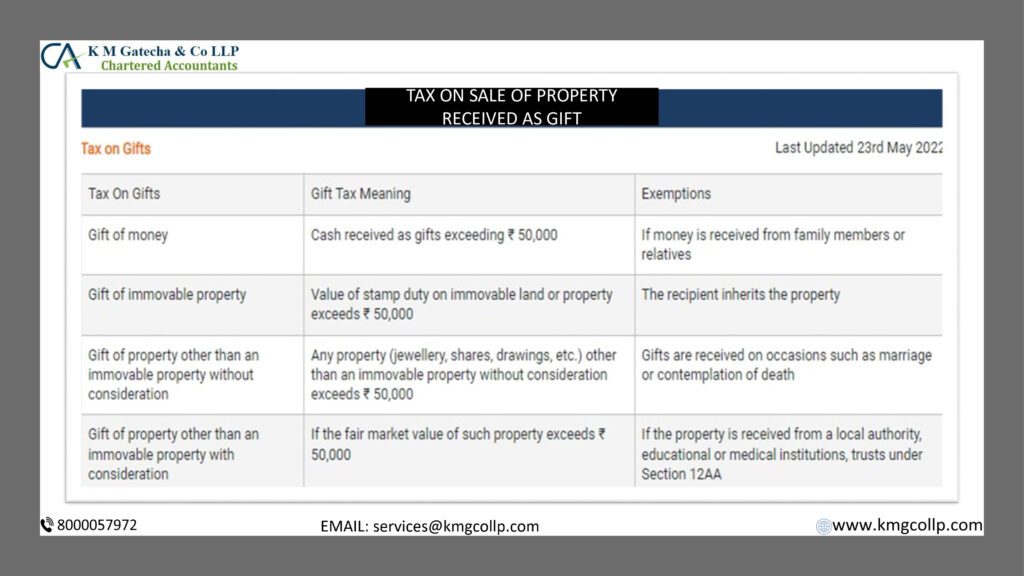

Tax Implications on Sale of Gifted Property | Gifts can be classified in the following ways in terms of taxation:

When you sell a property that you received as a gift in India, specific tax implications arise, primarily tax on sale of property received as gift. The capital gain is calculated based on the property’s original purchase price by the previous owner, not the value at the time of the gift.

- A monetary gift is a sum of money given without expecting anything in return.

- ‘Gift of moveable property’ refers to a specific movable item received without consideration.

- Movable property received at a lower price (i.e., for insufficient consideration) is known as the movable property received for less than its fair market value.’

- Immovable property obtained without payment is referred to as a “gift of immovable property.”

- Immovable properties purchased at a discount (i.e., for insufficient consideration) are referred to as “immovable property received for less than its stamp duty value.”

If the stamp duty on immovable land or property, received without any consideration exceeds 50,000 in a financial year then the gifted property is taxed in India. However, if any gifted property is derived from local authorities or any fund, foundation university, educational or medical institutions, charitable funds, etc. it is exempted from gift tax irrespective of the value of stamp duty.

Determining the Holding Period

The holding period of the property is crucial in determining whether the gain is categorized as short-term or long-term:

- Short-Term Capital Gain (STCG): If the combined holding period (of both the previous owner and the recipient) is less than 24 months.

- Long-Term Capital Gain (LTCG): If the combined holding period exceeds 24 months.

The holding period includes the duration for which the previous owner held the property, ensuring that the recipient benefits from the total holding time.

How to calculate tax on the sale of property received as gift:

Calculating Capital Gains

The calculation of capital gains involves the following steps:

- Determine the Sale Consideration: The amount for which the property is sold.

- Deduct the Indexed Cost of Acquisition: Adjust the original purchase price using the Cost Inflation Index (CII) to account for inflation.

- Deduct the Indexed Cost of Improvements: Adjust any expenses incurred on property improvements using the CII.

- Subtract Expenses Related to the Sale: Include brokerage fees, legal expenses, etc.

The formula is:

**Capital Gain = Sale Consideration – (Indexed Cost of Acquisition + Indexed Cost of Improvements + Sale-related Expenses)**

For properties acquired before April 1, 2001, the fair market value as of that date can be considered for indexation purposes.

Tax Rates Applicable for tax on sale of property received as GIFT

- LTCG: Taxed at 20% with indexation benefits.

- STCG: Taxed as per the individual’s applicable income tax slab rates.

Exemptions Available for tax on sale of property received as GIFT

Certain exemptions can be availed to reduce tax liability on LTCG:

- Section 54: Exemption on LTCG if the proceeds are reinvested in purchasing or constructing another residential property within specified timelines.

- Section 54EC: Exemption if the gains are invested in specified bonds (e.g., NHAI or REC bonds) within six months of the sale, subject to a maximum investment limit.

These exemptions have specific conditions and timelines that must be adhered to for eligibility.

Documentation and Compliance for tax on sale of property received as GIFT

Maintaining thorough documentation is essential:

- Gift Deed: A registered document evidencing the transfer of property as a gift.

- Original Purchase Documents: To establish the cost of acquisition and holding period.

- Improvement Receipts: Invoices and receipts for any improvements made to the property.

- Sale Agreement: Details of the sale transaction.

Proper documentation ensures accurate calculation of capital gains and supports claims for exemptions.

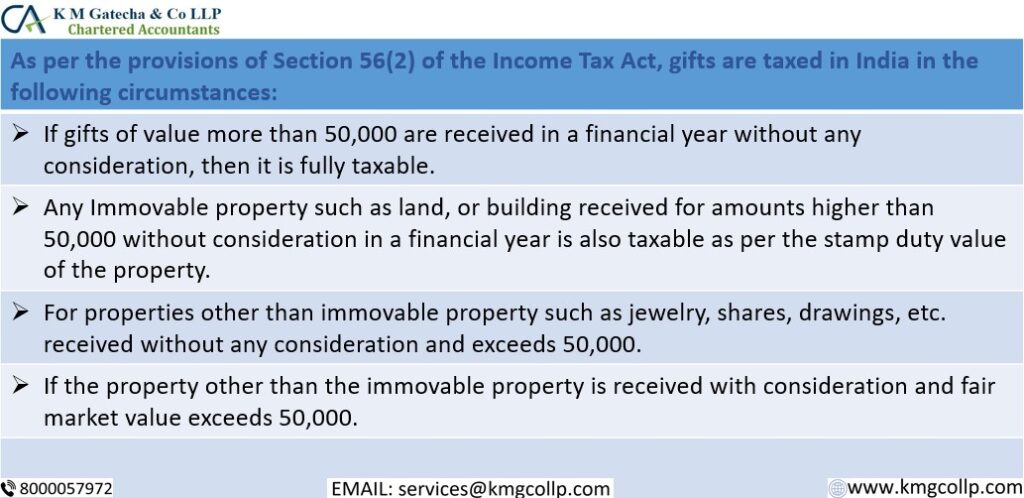

As per the provisions of Section 56(2) of the Income Tax Act, gifts are taxed in India in the following circumstances:

- If the value of a gift exceeds 50,000 in a fiscal year and is given without consideration, it is completely taxable.

- Any immovable property, such as land or a structure, received for more than 50,000 without consideration in a fiscal year is additionally taxable at the stamp duty value.

- For properties other than immovable property such as jewelry, shares, drawings, etc. received without any consideration and exceeds 50,000.

- If the property other than the immovable property is received with consideration and reasonable value exceeds 50,000.

as per the provisions of Section 56(2) of the Income Tax Act, a gift in any form received from relatives including spouse, brother or sister of parents, brother and sister of self and spouse, parents in law, any lineal ascendant or descendant of self or spouse is not taxable irrespective of the amount of gift.

You do not have to pay gift tax if you have received cash or if the stamp duty value on immovable property is less than 50,000. In cases, where the property is received from any medical or educational organization, charitable funds, or local authorities, or the property is inherited, or gift received from family members you can file these gifts as ‘Income from exempt sources’ while filing Income Tax Returns.

In India, property obtained from a family member, a local government, a charitable fund or non-governmental organization, medical or educational institutions, or on events such as property inheritance, marriage, or the anticipation of death is not taxable. If the value of the gift is below 50,000, received from any person is also tax-free.

The basic step to calculate tax on the sale of property received on inheritance or as a gift:

As we all know that capital gains tax is not applicable to a gifted or inherited property as there is no sale, only a transfer of ownership. Capital gains tax will be applicable only if the person who inherited the property or assets decides to sell it. the procedure to calculate the capital gain tax is given below:

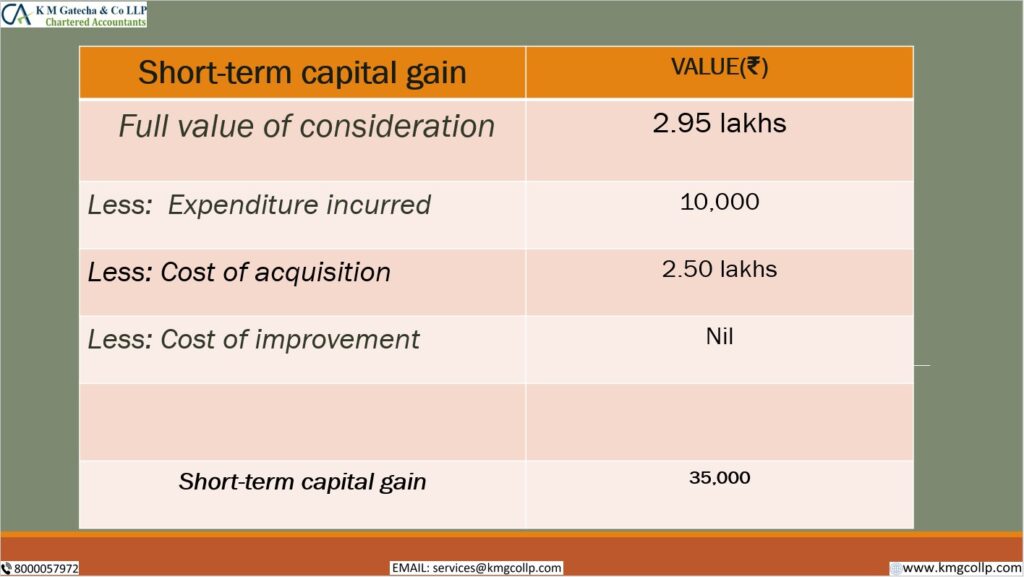

Short Term Capital Gains on Gifted properties are calculated as below:

Step: total sale price (full value of consideration)

less Expenses related to sale /transfer

less cost of purchase (acquisition cost)

less cost of improvement

Equals to Net short term capital gain

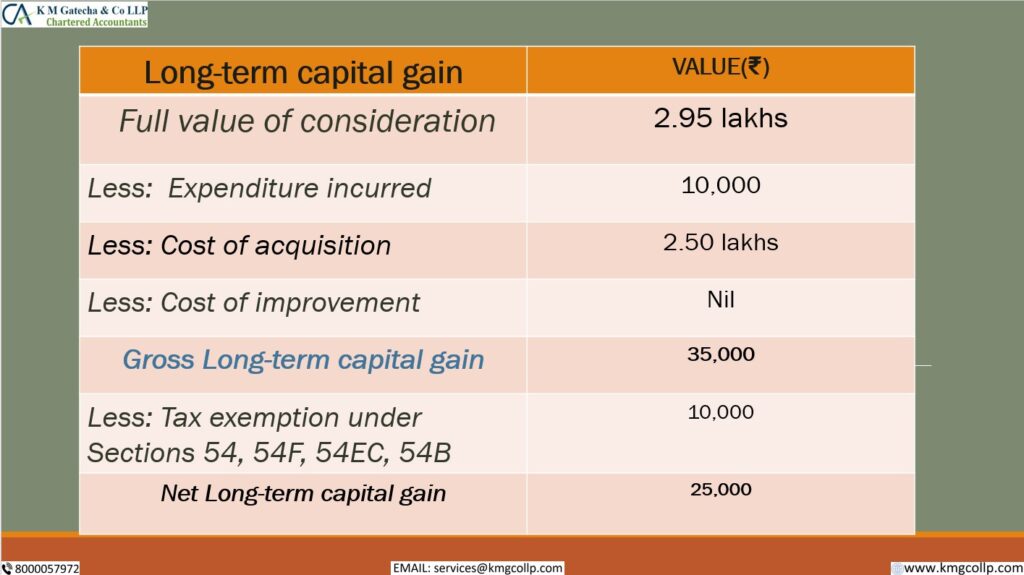

Long Term Capital Gains on Gifted properties are calculated as below:

sale of inherited/gifted property & calculation of long-term capital gains

total sale price (full value of consideration)

less expenses related to sale/transfer

less Indexed cost of purchase

less indexed cost of the improvement (if any)

Gross long term capital gains

Less Exemptions u/s 54 series

Equals to Net long term capital gains

The Long-Term Capital Gains calculation is quite similar to Short Term Capital Gains. Selling a property received as a gift in India involves specific tax considerations, primarily focusing on capital gains tax. Understanding the nuances of holding periods, calculation methods, applicable tax rates, and available exemptions is vital for compliance and effective tax planning. differences are that you are allowed to deduct the Indexed Cost of purchase/Indexed Cost of Improvements from the value of consideration and also claim certain exemptions to save tax on long-term capital gains.

Frequently Asked Questions for tax on sale of property received as GIFT

When a person inherits the property or receives it as a gift, it is not taxable to the person who receives it. The capital gains on the sale of this gift of property by the inheritor or recipient are taxable to the inheritor.

The following is the formula for calculating short-term capital gains on gifted property: STCG = (Total Sale Price) – (Acquisition Cost) – (Directly Related Sale Expenses) – (cost of improvements).

The value of all gifts received by a person during a year is fully exempt under income tax laws, as long as the total value of such gifts does not exceed Rs 50,000 in a year.

Table of Contents

Toggle