India is the biggest maker for generics. In terms of volume and value, the nation’s pharmaceutical industry is currently third largest in the world. The demand for better healthcare services is also rising with the population. The healthcare sector currently receives 5% of the country’s GDP.

Patients and their families pay the majority of healthcare costs themselves, not the government. Nonetheless, the Public authority of India has somewhat limited the weight on clinical use via excluding such costs from duty of Expenses.

The provision of health care services was excluded from the scope of the service tax regime. In the GST regime, the same exemption has been granted. In any case, what is going on with medical care administrations on which exclusion is allowed, we need to comprehend the idea of administrations as of now excluded under GST. If we do not cover all aspects of health care services, such as the taxability of physician consultation fees, hospital room rent, medications, medical and clinical tests, ambulance services, blood banks, and the treatment of clinical waste, our discussion of GST will be incomplete. In addition, we would like to talk about whether doctors can be taxed on income they earn outside of their practice. The GST influence on different issues are as under:

Exemptions notification on Health Care services under GST:

Notification No. 9/2017- Integrated Tax (Rate) dated 28.06.2017 has exempted health care services vide entry no 77 which is reproduced as under:

“Healthcare Services by a Clinical Establishment or Authorized Medical Practitioner or Para medics are exempt from Goods and services tax”

For understanding the exemption, we need to understand below important terms used in the said notification. These terms are also defined/clarified in the explanations given in the notification as:

- Health care services

- Clinical establishment

- Authorized Medical Practitioner

- Paramedics

- Health care services :

The aforementioned notification defines health care services as any service by way of diagnosis, treatment, or care for illness, injury, deformity, abnormality, or pregnancy in any recognized system of medicine in India. It also includes services by way of transportation of the patient to and from a clinical establishment. Hair transplants and cosmetic or plastic surgery, on the other hand, are excluded from this definition unless they are performed to restore or reconstruct the anatomy or functions of the body that have been affected by congenital defects, developmental abnormalities, injury

The term “health care” is defined by the Oxford Dictionary as “the maintenance and improvement of physical and mental health,” particularly through the supply of medical services.

- Clinical establishment :

According to the said warning, importance of clinical foundation is: –

A clinical establishment is a place established as an independent entity or a part of an establishment to carry out diagnostic or investigative services of diseases. It can also be referred to as a hospital, nursing home, clinic, sanatorium, or any other institution by any name that offers services or facilities requiring diagnosis, treatment, or care for illness, injury, deformity, abnormality, or pregnancy in any recognized system of medicine in India.

Section 2(e) of the Clinical Establishments (Registration and Regulation) Rules, 2010 defines clinical establishment as: (i) a hospital, maternity home, nursing home, dispensary, clinic, sanatorium or an institution by whatever name called that offers services, facilities requiring diagnosis, treatment or care for illness, injury, deformity, abnormality or pregnancy in any recognized system of medicine established and administered or maintained by any person or body of persons, whether incorporated or not; or

(ii) a place established as an independent entity or part of an establishment referred to in sub clause (i), in connection with the diagnosis or treatment of diseases where pathological, bacteriological, genetic, radio logical, chemical, biological investigations or other diagnostic or Investigative services with the aid of laboratory or other medical equipment, are usually carried on, established and administered or maintained by any person or body of persons, whether Incorporated or not, and shall include a clinical establishment owned, controlled or managed by the :

The Government or a department of the Government;

A trust, whether public or private;

A corporation (including a society) registered under a Central, Provincial or State Act, whether or not owned by the Government;

A local authority; and

A single doctor,

But does not include the clinical establishments owned, controlled or managed by the Armed Forces constituted under the Army Act, 1950, the Air Force Act, 1950 and the Navy Act, 1957.

Meaning of various categories of Clinical Establishment as used in the above definition:-

- i) The hospital: According to the World Health Organization (WHO), “hospital” refers to health care facilities with inpatient facilities, organized medical and other professional staff, and 24 hours a day, 7 days a week delivery of medical, nursing, and related services. Clinics offer a changing scope of intense, recuperating and terminal consideration involving demonstrative and healing administrations in light of intense and ongoing circumstances emerging from sicknesses as well as wounds and hereditary peculiarities.

(ii)Maternity Home: Implies any premises utilized or planned to be utilized for gathering of pregnant ladies or of ladies in labor or following labor

(iii) Nursing home: refers to any location, including a maternity home, that is used or intended to receive people who are ill, injured, or disabled and provide them with care and treatment. A nursing home is a small, private facility that also offers housing and medical care.

(iv) Clinic: a health care facility that is smaller than a hospital and is run by a single doctor or group of doctors. Most of the time, clinics only treat outpatients and may have a short-term observation room. A sanatorium is a place where people who have been sick for a long time with a chronic disease like tuberculosis or another disease can get treatment and rest, often in a healthy environment.

- Authorized medical professional:

As per the said notification, authorized medical professional means: –

A Clinical Specialist enrolled with any of the chambers of the perceived arrangement of drugs laid out or perceived by regulation in India and incorporates a clinical expert having the essential capability to rehearse in any perceived arrangement of medications in India according to any regulation for the time being in force. The requirements for being an authorized medical professional are outlined in the definition:

Practitioner should be registered with any medical council;

Practitioner should have requisite qualification to practice;

Such qualification should be of any system of medicine recognized in India.

In India, recognized medical systems include: Allopathic , Ayurveda ,Siddha, Unani, Homeopathy, Yoga and Naturopathy.

As a result, qualified doctors with recognized degrees in any of the aforementioned systems who are registered with their respective medical councils are included in this entry.

In conclusion, no one, whether as an individual or as part of a clinic or hospital, is required to pay GST if they receive any kind of medical treatment from a properly qualified doctor who is affiliated with a reputable medical council. This does not include cosmetic surgery or hair transplants.

- Paramedics:

These are prepared medical services experts, for example, nursing staff, physiotherapists, professionals, lab collaborators and so on. They are responsible for their administrations when given autonomously and in this manner excluded. In a clinical setting, their services would be rendered as employees rather than independently, and as a result, they would be regarded as services provided by that clinical setting. In a similar vein, the assistance of a licensed medical professional would only be considered a service provided by that licensed medical professional.

Other Exemption under the above notification No 9/2017

(i) Services provided by veterinary doctors: (Entry No 48) : This entry exempts services in relation to health of animals and birds from GST. This entry does not have any prerequisite with regard to qualification, recognition or affiliation.

(ii) Blood Banks: (Entry No 76) : Cord Blood Banks include other Blood Banks and thus the services provided by Cord/Other Blood Bank for preservation of stem cells or any other services for such preservation are covered in Entry No: 76 and are thus Exempt from GST.

(iii) Ambulance Services: (Entry No 77) : Providing of ambulance services are also exempt from the ambit of GST. GST or service tax is not applicable on ambulance services provided to Government under National Health Mission – MF(DR) (TRU) circular No. 51/25/2018-GST dated 31-7-2018 in respect of GST and CBI&C circular No. 210/2/2018-ST dated 30-7-2018 for service tax.

(iv) Medical Tests: (Entry No 77) :Medical Test (either done in own Clinical establishment or done in the separate clinical establishment setup specially for such test) are covered in Entry No 77 and are thus Exempt. any GST.

(v) Bio Medical Waste: (Entry No 78):This entry excludes unconditionally, services provided by operators of the common bio-medical waste treatment facility to a clinical establishment by way of treatment or disposal of bio-medical waste or the processes incidental thereto. Thus, services provided to hospitals by way of treatment and disposal of bio medical waste is not taxable under GST under the strength of this entry

(vi) Room rent for patient (Entry No 77 ) : Rent charged for rooms for patients are not taxable under GST. However, if the hospital is renting space for a chemist shop or providing rooms on rent for care takers, then that would attract GST.

(vii) Services provided by hospitals under health care service are naturally bundled services and exempted under GST Act

Sl | Description | Reference | Remarks |

a | Medicines, Consumables, in-plants | Kindorama Healthcare (p) Ltd in re[2019] AAR-KERALA | Supplied by hospitals to patient during diagnosis or treatment |

b | Food Supplies to patients | CBI&C response on FAQ dt 15.1.2.2018 ON GST Chapter 4A No. 28 | Its a composite supplies with health care services |

c. | Room Rent in hospital | CBE&C circular No. 27/1/2018, dated 4-1-2018. | it is a composite service where principal supply is of health care]. |

d | Diagnosis and pre and post counselling service | Sayre Therapuetics (P.) Ltd., In re* [2018] AAR-Karnataka | its qualify as healthcare services which attract nil rate of central tax. |

e | Diagnosis and counselling centres | Medivision Scan & Diagnostic Research Centre (P.) Ltd., In re [2019] AAR – Kerala | qualifies as a clinical establishment |

(viii) Retention money kept by hospital from payments to consultants/technicians In some cases, hospital allows private doctors to use consulting rooms in hospitals. The patient pays fees to hospital out of which hospital pays certain amount to the private doctor/technician. For example, the hospital may collect fee of Rs 10,000 out of which Rs 7,500 are paid to the private doctor/technician. The amount retained by hospital is to provide ancillary services like infrastructure, nursing, paramedic care, emergency services etc .GST is not applicable on amounts paid to retention money kept by hospital from payments to consultants/technicians – CBI&C circular No. 32/06/2018-GST dated 12-2-2018. (Sir Ganga Ram Hospital v. CCT (2018) 94 taxmann.com 226 (CESTAT).)

(ix) Services provided by rehabilitation professionals recognised under the Rehabilitation Council of India Act, 1992 by way of rehabilitation, therapy or counselling and such other activity as covered by the said Act at medical establishments, educational institutions, rehabilitation centers established by Central Government, State Government or Union territory or an entity registered under section 12AA of the Income tax Act, 1961 (43 of 1961) are exempt w.e.f. 1-1-2019 – Sr No. 74A of Notification No. 12/2017-CT (Rate) and No. 9/2017-IT (Rate) both dated 28-6-2017, inserted w.e.f. 1-1-2019.

Health care Services which are not exempted under GST : –

(i) Sale of Medicines is Taxable: Medicines are taxable under GST. Although most of the medicines are taxed at 5% under GST laws but few are also taxed at 12% and some at 18%. We need to identify the HSN of the medicines / consumables / injectables and implants to ascertain the rate of tax applicable to them. If medicines etc. are purchased for resale then ITC is available and sale would attract tax.

(ii) In an establishment , tests done from outside accredited laboratory and giving consultancy is not clinical establishment and hence, exemption is not available. (J C Genetic India P Ltd. In re (2019) 73 GST 272 = 104 taxmann.com 88 (AAR-MP),)

(iii) Food supply to attendants or visitors or out patients on chargeable basis is not exempted . Further, tax is payable by supplier of foods if supply of food is outsourced – CBI&C circular No. 32/06/2018-GST dated 12-2-2018.

(iv) Tax payable if hospital gives part of premises on rent – GST is leviable on rent paid/payable for premises, given on lease by hospital – Tathagat Health Care Centre LLP,In re [2018] 93 taxmann.com 419 (AAR-Karnataka)

(v) Tax ability of other Income of Doctors : We shall also discuss about the other income of doctors in addition to the income from the medical profession and also discuss about the necessity of the registration in GST. GST is applicable on amounts paid to senior doctors by hospitals.

The concept of aggregate turnover and registration:

Under GST, a person is identified by his PAN. When his annual total of sales exceeds Rs 20 lakh (with the exception of special category states, where the limit is Rs 10 lakh), he must register. The total turnover implies entirety of all outward supplies of labor and products or both made by a Dish element anyplace in India. This includes supplies that are taxable, tax-free, or exempt. A person is not required to register if their total outward supplies are exempt or not taxable. In any case, where even a little piece of administrations gave or merchandise sold are available, he is expected to get enlisted. Additionally, registration is required in all states where the business operates.

Example: a person who has a hospital in Delhi, Haryana, and Uttar Pradesh. He also has shops in these states that he rents out. His annual turnover from the hospital and the rental income from the shops exceed Rs 20 lacs. He must register in these states because the registration threshold has been reached.

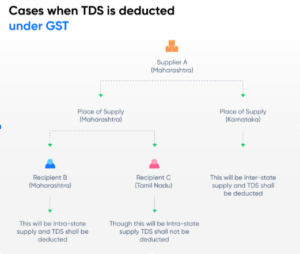

Taxability on Reverse Charge:

The provisions of reverse charge will apply to any doctor, clinic, or hospital that needs to be registered because its total turnover includes any portion of taxable supply. There are three broad categories of reverse charge. section 9(3)-specified services, section 9(4)-specified imports, and inward supply from a specified person. ITC on charge paid on turn around charge is accessible however dependent upon limitations and negative rundown inbuilt in the demonstration.

Input Tax Credit :-

The import duty on technical machinery and equipment required by the health sector would be eligible for a credit under the GST. This advantage of the general decrease in the expense of innovation is because of execution of GST.

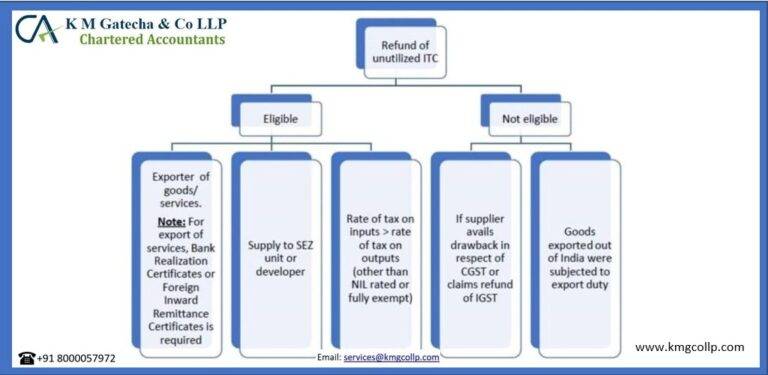

Inverted Duty Structure:-

One of the excellent worries for the medical services area is the rearranged obligation structure that antagonistically influences the homegrown makers. The raw materials are more expensive in terms of duty than the finished product itself, which discourages manufacturers from investing. The cost of inputs is much higher than the cost of output. The GST structure introduced a refund of the accrued credit as a means of resolving this issue. It has proven to be the most significant benefit for the healthcare industry and would encourage its expansion.

CONCLUSION:

The majority of health care services are exempt from GST due to their importance and the fact that they frequently save lives. However, the provision of services by plastic surgeons (when cosmetic in nature) as well as medicines, consumables, and other items are not exempt. Taxable are also the implants and artificial limbs that are necessary for life restoration. As a result, we are able to say that medical services are largely exempt but not entirely.

FAQs

What is the GST rate on hospital rooms?

Generally, the healthcare services provided by a hospital are exempt under GST. However, a GST rate of 5% will be levied on the cost of a hospital room if it exceeds Rs.5,000 per day.

What is the difference between pre-GST and GST?

In the pre-GST regime, the health care services were not under the scope of levy of Service Tax. In the GST regime the Government instead of giving full exemption to health care services but minimizes the burden of tax by exempting certain health care services as a welfare measures for the citizen of the country.

Disclaimer: The materials provided herein are for informational purposes only and do not constitute legal, financial, or professional advice. Consult relevant laws and experts before acting on this information. Neither the author nor K M GATECHA & CO LLP is liable for any inaccuracies or omissions. This material is purely educational and not an advertisement or solicitation.

Table of Contents

Toggle