Difference Between Private Limited Company & LLP – Analysis

When a layperson wants to start a business, it’s often hard to decide which business structure is best for their new entity. An entrepreneur can choose from a variety of business structures, but the LLP and private limited company are the most popular choices. These are the normal support points for a business person to fabricate his domain, this article examines the choices that a business person ought to consider while framing a venture: –

PRIVATE LIMITED COMPANY: –

The most common type of business entity is a private limited company. There is no base capital prerequisite, just 2 chiefs and individuals are expected to integrate private restricted organization. It shields members from unlimited liability in the event of the company’s demise or closure. Mca has altered the registration procedure and made it simple to incorporate them.

ADVANTAGES: –

SEPARATE JURISDICTIONS: – In the eyes of the law, a private limited company is treated like an individual. The company can hold funds and other assets in its name. LIABILITY LIMITATIONS: obligation of investors in the event of private restricted organization are restricted up to how much shareholding.

PERMANENT SUCCESS: – Because a private limited company has independent identity and perpetual succession, it will not lose its identity even if its shareholders or owners pass away. The company will not be affected by the change in shareholding.

EASY TO FORM: – joining of private restricted organization is more straightforward. MCA has altered the registration procedure.

CAPITAL Necessity: – no base capital is expected for fuse of private restricted organization, presently organization can be integrated with any sum.

LLP: – The LLP ACT of 2008 established and incorporated LLP as a body corporate. Because it offers the advantages of both a private limited company and a partnership firm, the LLP is the preferred form of organization. Llp is a lawful element isolated from its accomplices. Each partner is only liable for their own contributions, and no partner is liable for the actions of another partner. Each partner will be accountable for their own performance.

Benefits: –

EASY TO FORM: A LLP is easier to start and run because there are fewer formalities involved. The formation of an LLP requires less time and effort and requires fewer legal compliances.

The minimum amount of money needed: – There is no minimum capital requirement for incorporating an LLP; rather, any amount of capital can be used to incorporate an LLP.

SEPARATE Legitimate Substances: – A limited liability company (LLP) is similar to a legal entity that is independent of its partners. In the eyes of the law, it has its own existence.

LLP V/S PRIVATE LIMITED COMPANY

DIVIDEND DISTRIBUTION TAX: – LLP are not required to pay dividend to its partners so Dividend Distribution Tax is not applicable on llp.

ANANLSIS OF THE DIFFERANCES BETWEEN LLP AND PRIVATE LIMITED COMPANY: –

BASIS | COMPANY | LLP |

Registered under | Companies Act 2013 | Limited Liability partnership Act 2008 |

Directors required | Minimum -2 | Minimum designated partner-2 Maximum designated partner – not applicable |

Members required | Minimum -2 | Minimum -2 |

Minimum capital required | No minimum share capital required. | No minimum share capital required. |

Meetings | Minimum 4 board meetings required during financial year having 120 days gap between 2 meetings. | No requirement of partners meeting in llp. |

Abiding | Abiding by the aoa / moa of company. | Abiding by the llp agreement. |

Statutory audit | Mandatory | Not required unless partners contribution exceeds 25 lakhs and annual turnover exceeds 40 lakhs. |

Compliances | High legal compliances | Less legal compliances |

Tax structure | More complicated (dividend distribution tax has to be paid by company) | much easier (no dividend distribution tax) |

Reliability | more confidential | Less reliable |

investment | Companies has to go through with sections 73 and any other provisions and rules made their under. | There is no cap or criteria for the investment by any third party. |

FAQs

Two examples of such business structures are limited liability partnerships (LLPs) and private limited companies. India has long had private limited companies, or Pvt Ltd companies. Restricted Obligation Association (LLP) business structure was presented in India in 2008.

India has long had private limited companies, or Pvt Ltd companies. Restricted Obligation Association (LLP) business structure was presented in India in 2008. As a result, Pvt. Ltd. companies are more well-known and have been around longer than LLPs.

The Companies Act of 2013 and the LLP Act of 2008, respectively, regulate PLC and LLP as two distinct business entities. From the perspective of an entrepreneur who is just starting a new business, we will discuss the difference between a Private Limited Company and an LLP in this blog post.

Owner of this information can be reached at K M GATECHA & CO LLP.

Important note: This does not lead to legal advice or legal opinion and is personal view and for information purpose only. It is prepared on the basis of facts available and applicable law.It is suggested to go through applicable provisions of law,latest regulations,judicial announcements, circulars, notifications and clarifications etc before taking any action based on above content.You agree here by that for any action taken on basis of above information in any manner writer or K M GATECHA & CO LLP is not responsible or liable for any omission,reliability,accuracy,completeness,errors or authenticity.This work by professional is just for knowledge purpose and does not constitute any kind of solicitation of work or advertisement.

-

Section 10 Of Income Tax Act_ Exemptions, Allowances & How To Claim It15/08/2024/0 Comments

Section 10 Of Income Tax Act_ Exemptions, Allowances & How To Claim It15/08/2024/0 Comments -

Steps to register private limited company15/08/2024/

Steps to register private limited company15/08/2024/ -

Cancellation of registration under GST26/05/2024/

Cancellation of registration under GST26/05/2024/ -

-

Introduction to Transfer Pricing in India13/04/2024/

Introduction to Transfer Pricing in India13/04/2024/ -

-

-

Tax Liability of a NRI24/12/2023/

Tax Liability of a NRI24/12/2023/ -

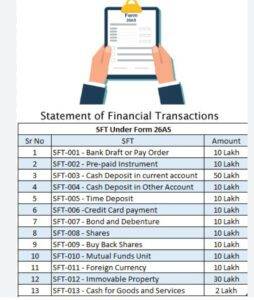

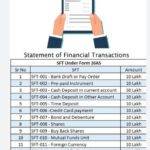

Everything about SFT18/12/2023/

Everything about SFT18/12/2023/ -

Documents to be maintained by NGo or trust17/12/2023/

Documents to be maintained by NGo or trust17/12/2023/ -

-

-

-

-

Taxation of Charitable/Religious Trust04/09/2023/

Taxation of Charitable/Religious Trust04/09/2023/ -

Application for Filing Clarification – GST09/06/2023/

Application for Filing Clarification – GST09/06/2023/ -

How to check GST application status09/06/2023/

How to check GST application status09/06/2023/ -

-

Gift tax under section 56(2)x03/06/2023/

Gift tax under section 56(2)x03/06/2023/ -

-

-

-

-

-

-

All about Appeal under GST20/05/2023/

All about Appeal under GST20/05/2023/ -

Old vs New income tax regime18/05/2023/

Old vs New income tax regime18/05/2023/ -

All about GSTR 10, GST Amnesty16/05/2023/

All about GSTR 10, GST Amnesty16/05/2023/ -

-

-

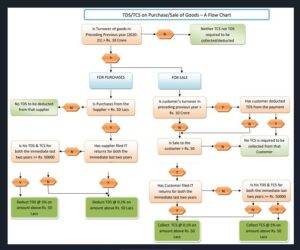

TDS on purchase of goods u/s 194Q17/01/2022/

TDS on purchase of goods u/s 194Q17/01/2022/ -

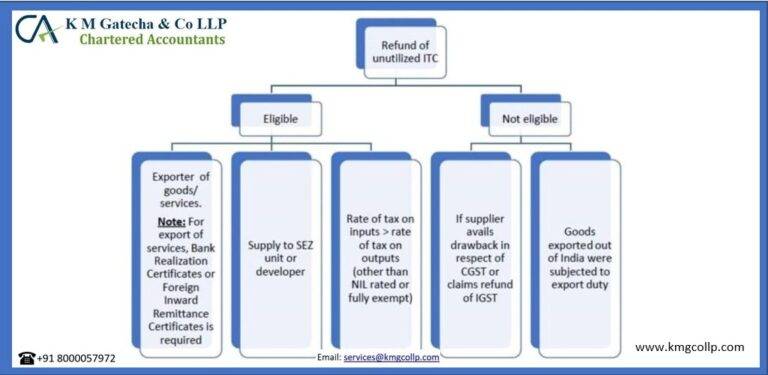

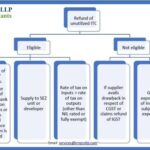

Situations of GST refund and process10/01/2022/

Situations of GST refund and process10/01/2022/ -

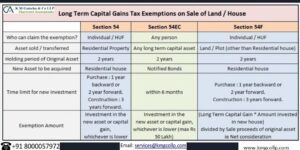

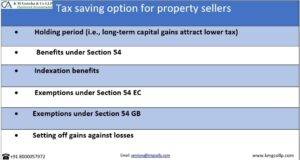

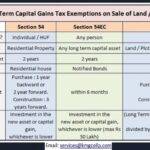

Tax on property sale in India05/01/2022/

Tax on property sale in India05/01/2022/ -

House Rent Deduction in Income Tax01/01/2022/

House Rent Deduction in Income Tax01/01/2022/ -

Valuation Report15/08/2024/

Valuation Report15/08/2024/

Table of Contents

Toggle