Indian payroll taxes and statutory compliances

In this manual, you'll discover the fundamentals of Indian payroll taxes and statutory compliances, including why it's important, how to execute it, what a good payroll process looks like, and…

In this manual, you'll discover the fundamentals of Indian payroll taxes and statutory compliances, including why it's important, how to execute it, what a good payroll process looks like, and…

The Income Tax Act of 1961 does not define the term "Expatriate Tax." However, in general, an expatriate is someone who lives outside of his country of origin or in…

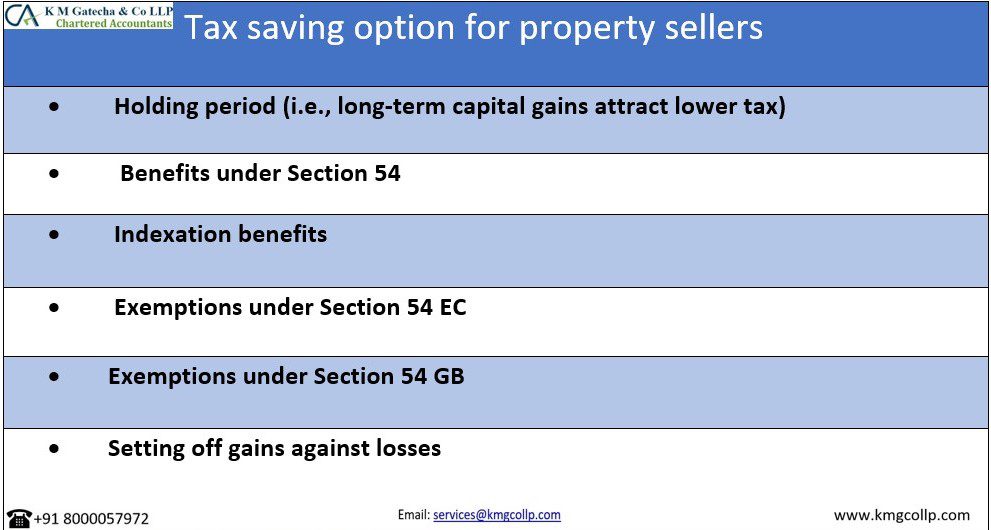

NRIs while selling their house properties in India must pay tax on the Capital Gains. The tax payable on the gains depends on whether it is a short-term or a…

Introduction India has the second-largest internet user base in the world. India’s e-commerce market after “India Goes Digital" has the fastest-growing country in the world. The rapid popularity and acceptance…

In this article we have discussed all about TDS and TCS under GST.The concept of Tax Deduction at Source (TDS) was there in the former VAT Laws. GST Law also…

In this article, we have discussed about mandatory Filings of Limited Liability of Partnership. In India, for all purposes of taxation, An LLP is treated like any other partnership firm.…

In this article, we have discussed about tax on freelancers income in India . India is the second-largest freelancing Market. freelancing has taken off quite a bit in the past…

As per the Income Tax Act of 1961, income tax must be deducted at source as per provision of the Income Tax Act, 1961.TDS stands for Tax Deducted at Source.…

TDS on purchase of goods u/s 194Q

Tax on property sale in India attract various taxes such as Gains, Cess and TDS which is to be calculated and paid while selling the property. These taxes are to…

Huge amount of payment is made regularly by business to transporters. Due to huge payment there are chances of mistakes. Non deduction of TDS u/s 194C on payment to transporter…