Situations of GST refund and process

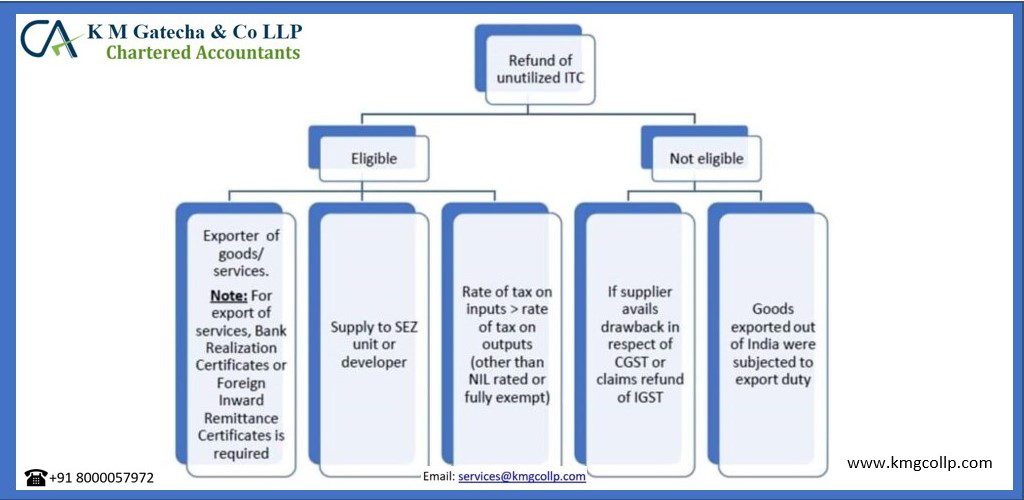

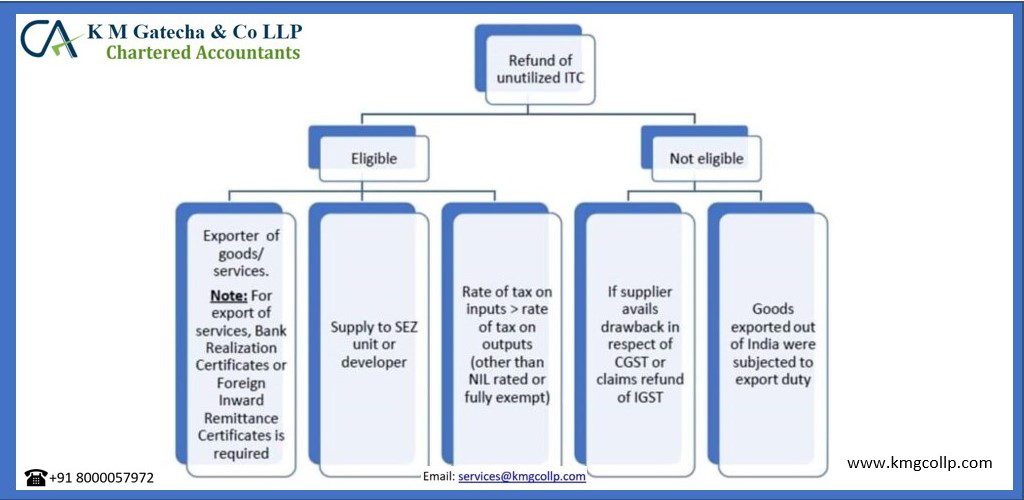

GST refund is a procedure in which a taxpayer wants to get the amount, which is in excess of the GST liability, refunded to his/her account.

GST refund is a procedure in which a taxpayer wants to get the amount, which is in excess of the GST liability, refunded to his/her account.

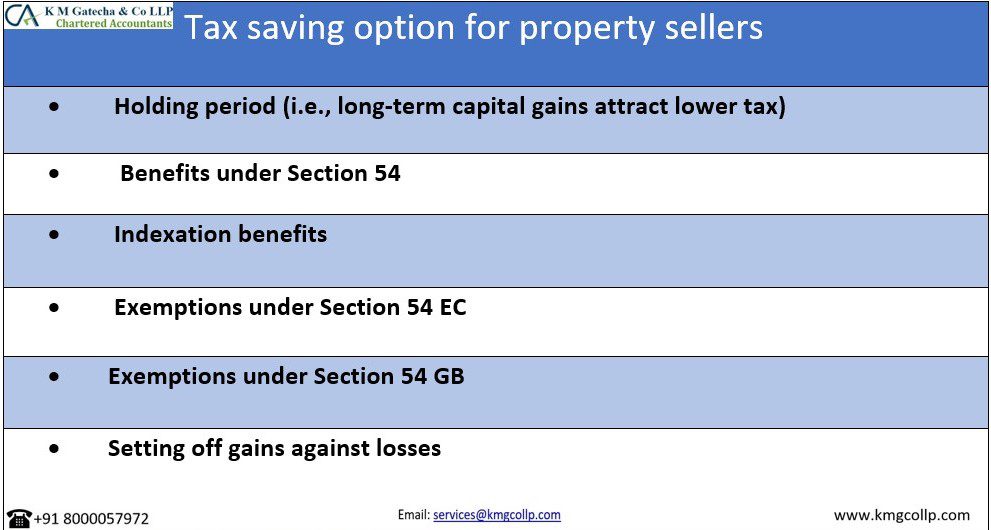

Tax on property sale in India attract various taxes such as Gains, Cess and TDS which is to be calculated and paid while selling the property. These taxes are to…

House Rent Deduction in Income taxHouse is one of the basic needs of any individual. Thus, the Government of India has made an allocation for deduction of rent paid by…

Cash deposit limit in bank account in a year as per income tax Cash deposit limit in bank account in a year as per income tax I this article we…

In this article we have discussed Interest and remuneration to partners as per Income Tax Act 1961.People are usually confused regarding income tax provision relating to payment of remuneration and…

Huge amount of payment is made regularly by business to transporters. Due to huge payment there are chances of mistakes. Non deduction of TDS u/s 194C on payment to transporter…